Forex Broker Types: Dealing Desk vs No Dealing Desk

Choosing a forex broker could be a challenging task that requires you to figure out what type of broker you want to trade with. Besides the trading platforms, trading tools, and risk management tools provided by forex brokers, you also need to consider the type of execution model.

A broker’s execution model is the method through which they execute your forex trades in your live trading account. For that matter, forex brokers can be divided into dealing desk and no dealing desk forex brokers execution models. And each one has its pros and cons.

So, with that in mind, let’s get started and see which type of forex broker is best for you.

What is a Dealing Desk Broker (DD)?

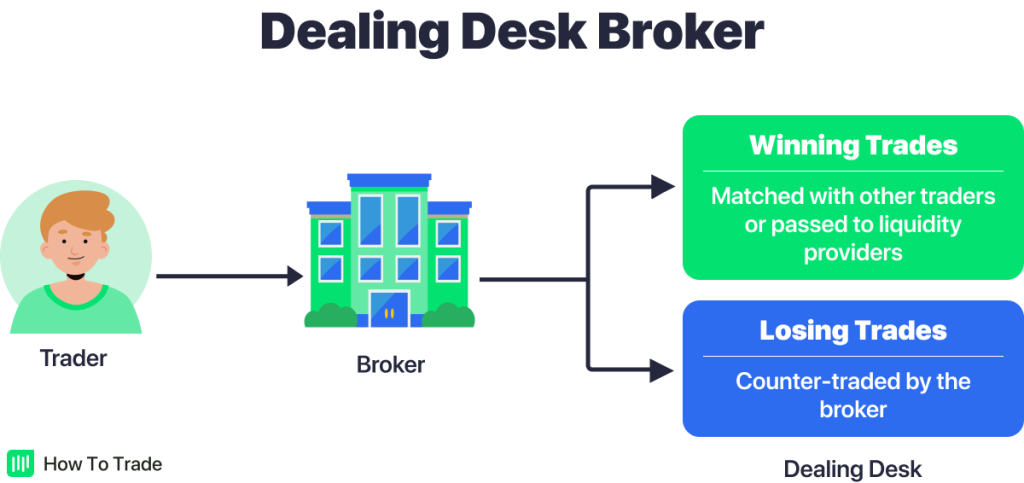

Dealing Desk brokers, also called Market Makers, are a type of broker that takes the opposite side of their clients’ trades. So, if you want to go short (sell) on a currency pair, the broker goes long (buys from you), causing you and the broker to be on opposing sides of the same trader.

The trade goes in your favor, and you earn the difference between the opening price and the closing price of the trade. Trade goes against you, and the broker goes home with your margin. So, it’s like a direct bet between you and your broker. Essentially, DD brokers profit from their traders’ losses and their bid-ask spreads.

In most cases, a DD broker keeps your order in-house, within its liquidity pools, and does not execute it to the real forex market. This means that dealing desk execution is mostly based on your trust in your market maker broker.

How Do Dealing Desk Brokers Work?

Assume you placed a buy order for EUR/USD for 1 Lot with your Dealing Desk forex broker.

To fill your order, your forex dealing desk broker will first try to find a matching sell order from its other retail trader clients or pass your trades on to its external liquidity providers in the interbank market (other financial institutes, banks, etc). By doing this, they minimize their risk, as they earn from the spread without taking the opposite side of your trade.

If there are no matching counter orders, they will take the opposite side of your trade.

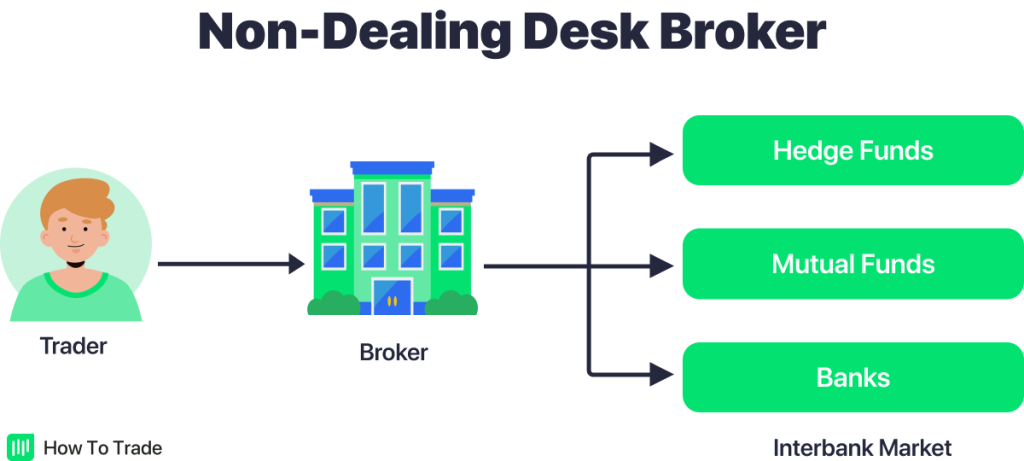

What is a No Dealing Desk Broker (NDD)?

As the name signifies, No Dealing Desk (NDD) brokers do NOT pass their clients’ orders through a Dealing Desk. Instead, NDD forex brokers send the buy and sell orders directly to the forex market (via liquidity providers, banks, other brokers, etc).

Think of an NDD forex broker as a bridge builder. They match two opposite trades placed by two market participants and make a bridge to join them.

The prices you see on your forex trading platform are live quotes from global banks, which means that with an NDD broker, the price you have when you click is the final price for your position.

Keeping the above in mind, No Dealing Desk forex brokers can be of two types: STP or ECN.

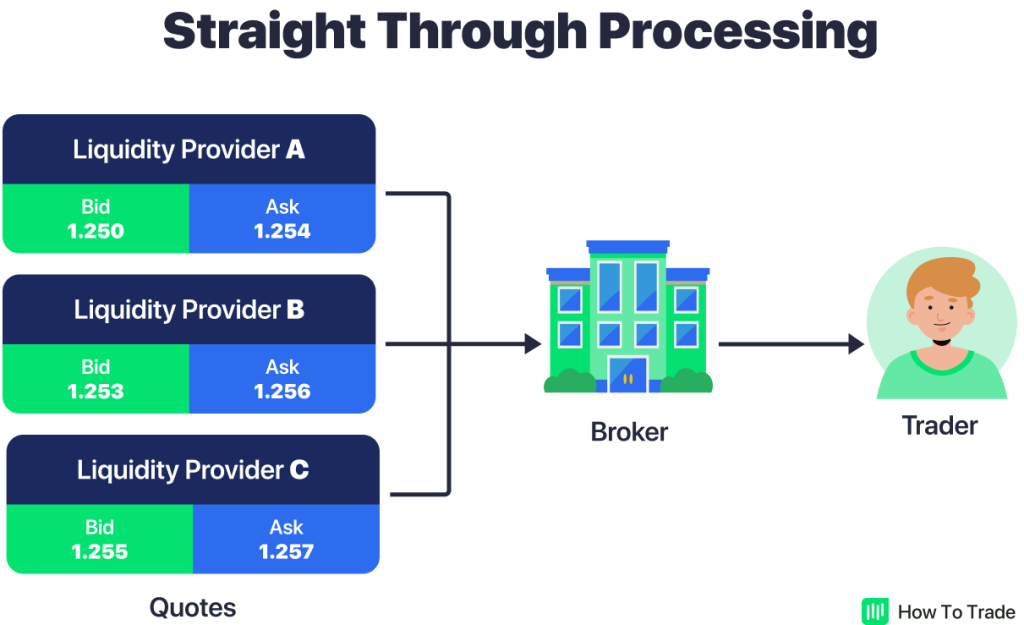

What is an STP Forex Broker?

A Straight Through Processing (STP) broker simply routes the orders of its clients directly to liquidity providers, who have access to real-time interbank market rates. These No Dealing Desk STP forex brokers usually work with many liquidity providers, with each provider quoting their bid and ask prices and executing their clients’ forex trades.

For example, let’s say your NDD STP broker has direct access to multiple liquidity providers in the interbank market. That means that in their trading platform system, they will see three different quotes of bid and ask prices for each of the currency pairs as below.

- Liquidity Provider A: Currency Pair: EUR/USD, Bid Price: 1.1250, Ask Price: 1.1254

- Liquidity Provider B: Currency Pair: EUR/USD, Bid Price: 1.1253, Ask Price: 1.1256

- Liquidity Provider C: Currency Pair: EUR/USD, Bid Price: 1.1255, Ask Price: 1.1257

From the example above, you can see that the best available bid price for EUR/USD is 1.1255 (selling high), and the best ask price for the same pair is also 1.1254 (buying low). This is the main benefit when you trade forex with an STP broker – you get the best price available in the Foreign Exchange market.

However, as compensation for their efforts, NDD forex brokers will add a small commission, usually fixed spreads. So, if their policy is to add a 1-pip markup, the quote you will see on your platform would be 1.1254/1.1255. Even the best NDD forex broker does this. It’s just how they make their money.

When you decide to buy 100,000 units of EUR/USD at 1.1255, your order is sent through your STP broker and then routed to either Liquidity Provider A or B.

If your order is filled, the chosen Liquidity Provider will have a short position of 100,000 units of EUR/USD 1.1254, and you will have a long position of 100,000 units of EUR/USD at 1.1255. Your broker will earn one pip in revenue.

What is an ECN Broker?

An ECN (Electronic Communication Network) broker provides its traders with direct market access to other participants in the currency market. By using the Electronic Communications Network technology, ECN brokers can connect retail forex traders to other participants in the forex market, which can be banks, retail investors, hedge funds, central banks, and even other brokers. In essence, market participants trade against each other by offering their best bid and ask prices.

An ECN forex broker is the purest form of middleman and makes money by charging a small commission on each position. Unlike market-making brokers, this trading model of ECN brokers ensures that there is no conflict of interest, as they get their commission whether you make or lose money when trading forex.

It is its transparency and access to real-life information that makes it appealing to most forex traders.

Which Should You Choose?

That’s up to you!

One type of forex broker is not necessarily better than the other in all conditions. It is your choice to decide whether you would like tighter fixed spreads offered by dealing desk brokers, or if you are comfortable paying a commission on variable spreads per trade from no dealing desk forex brokers.

Usually, day traders and scalpers prefer tighter spreads because it is easier to take small profits as the market needs less ground to cover to get over transaction costs. And they choose a dealing desk broker. Meanwhile, wider spreads tend to be insignificant to longer-term swing or position forex traders, so they often choose No Dealing Desk forex brokers.

Choosing the right forex broker comes down to your trading style and the type of trader you are. Some people have difficulties with the notion of trading against their forex broker and are afraid of market manipulation.

On the other hand, since the forex market has become highly regulated in recent years, most market makers are no longer manipulating prices, making forex trading reasonably safe. Instead, these dealing desk brokers simply rely on the statistics that most traders are losing money rapidly in forex trading and thus keep all forex trades in-house.

Key Takeaways

- Forex brokers are of two types depending on their trade execution model: dealing desk brokers and no dealing desk forex brokers.

- Dealing desk brokers take the opposing sides of their traders’ orders. So when a forex trader goes long, the broker goes short.

- No dealing desk forex brokers are merely trade facilitators who pass traders’ trades to liquidity pools or interbank markets for execution. Through them, traders trade directly with the interbank market.

- Dealing desk brokers make their money off the spreads and the losses of their traders. No dealing desk forex brokers rely on commissions and spreads.

If you want to explore the advantages and disadvantages of these two types of brokers, the next lesson is for you.