Why Trade Forex: Forex vs Stock Market

Stock market trading and Forex Trading are both viable paths to financial success. Still, before you start trading Forex or you trade Stocks, it is important to find out which is best suited for your trading strategy, your trading style, and your risk appetite.

Deciding which financial markets to trade does not have to be complicated, and many factors can be considered to make the best choice.

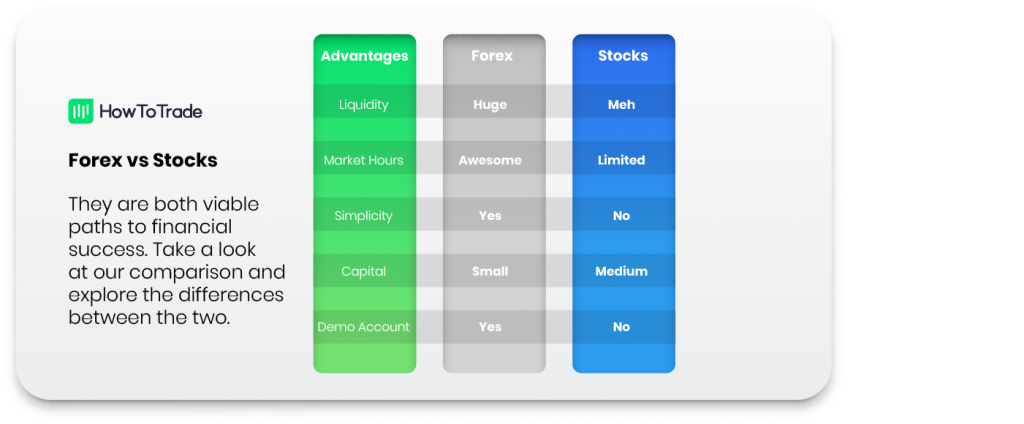

Take a look at our Forex vs. Stocks comparison and explore the key differences between forex trading and stock trading.

Forex vs Stock Market

Below, you can find six main factors that will help determine which market is best for you – the foreign exchange market or the stock market.

1. Liquidity

The Foreign Exchange market is the most liquid financial market in the world, with an average daily trading volume exceeding $7.5 trillion. The Forex market can absorb trading volume and transaction sizes that dwarf the capacity of any other market. This high liquidity essentially means you’ll get market execution when trading forex, and you’ll never get into a situation where you won’t find a buyer or a seller.

Let’s use the stock market for comparison.

All the world’s combined stock markets don’t even come close to the daily trading volume in the Forex markets. The largest stock market, the New York Stock Exchange, (only) trades an average daily volume of $22.4 billion.

2. Market Trading Hours

The Forex market never sleeps! The FX market is open 24 hours a day and five days a week, only closing during the weekend.

This is convenient for those who don’t want to quit their full-time job and dedicate their life to trading because you can choose when you wish to trade.

The trading sessions for the stock market, on the other hand, are limited to an exchange’s opening hours. For example, in the U.S., most stock exchanges open at 9:30 AM EST and close at 4:00 PM EST.

3. Simplicity

There are approximately 2,800+ stocks listed on the New York Stock Exchange. Another 3,300+ are listed on the NASDAQ. It can be challenging for even the most seasoned traders to keep an eye on them all.

You may argue that with the currency market, there are hundreds of currencies to trade. However, the major ones are only a few, and there are usually a lot of trading opportunities with these currency pairs.

On the other hand, most forex traders tend to lean into a few major currencies. About 7 of them. And seven major pairs are much easier to watch than thousands of shares, don’t you think? (Especially when you have the HowToTrade free courses by your side every step of the way).

4. Capital Required

Getting started as a Forex trader doesn’t necessarily cost a ton of money, especially if compared to trading stocks or futures.

When trading CFDs, online Forex brokers offer ‘mini’ and ‘micro’ trading accounts, some with a minimum account deposit of just $25. Also, forex market offers leverage trading up to 1000:1 sometimes through their brokers. So you can use low initial investment and take advantage of small market movements.

Now, we are NOT saying you should open a trading account with the bare minimum, but it does make currency trading much more accessible to individuals who want to test the waters before diving in too deep!

5. Free Demo Account

Most online Forex brokers offer free demo accounts to practice trading before risking your hard-earned money. Free demo accounts are valuable resources for all beginner Forex traders who want to sharpen their trading skills with pretend money and ZERO risk.

Again, this is something stock traders can envy, as demo accounts are unheard of in the stock market.

6. Market Influences

For both markets, the laws of supply and demand are in full force. However, some factors affect the demand and supply of these financial markets.

The stock market, for instance, is influenced by the happenings within the company whose stock you’re trading. Their financial reports, including their revenues, debts, and other important financial figures, affect where the stock price goes.

For the forex market, though, the forces influencing its demand and supply are much more complex. We’re talking macroeconomics of the countries involved in the currency pair you’re trading and not just one economy. The forex market also has participants like central banks and large commercial banks whose activities can affect the market’s direction. Other significant players in the forex market are institutional investors and hedge funds.

Stock Market Trading or Forex Trading?

Both forex and stock markets are great markets for beginner traders to start their trading journey. These popular global markets provide higher trading volume than other markets and the ability to make money from future price movements.

Still, like all things in life, you must learn to crawl before you can walk. And Forex or stock trading is no different.