What are Currency Pairs in Forex?

The forex market revolves around what we call currency pairs. They’re the instruments we trade in the market, like the items you buy or sell at the market.

So, what are currency pairs?

What is a Currency Pair?

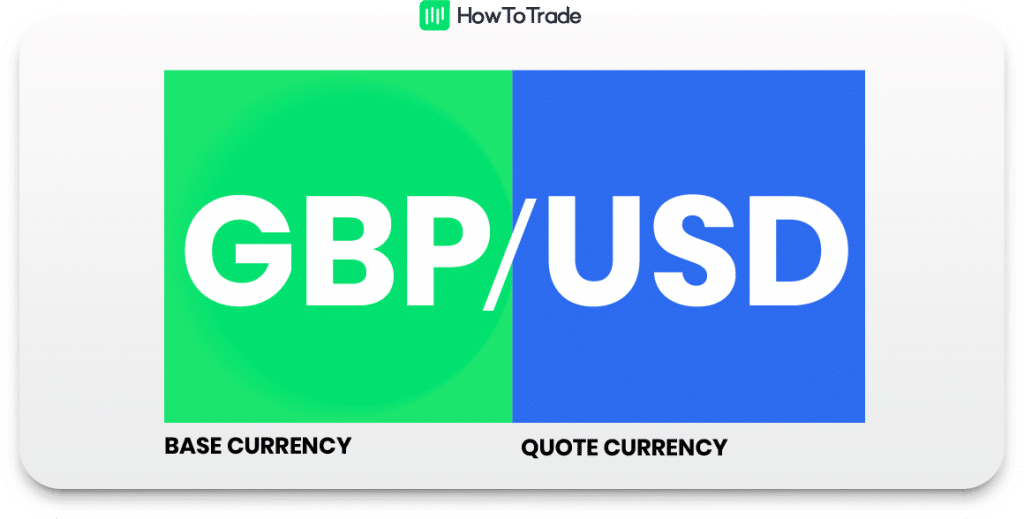

A currency pair in forex trading is a pair of two national currencies whose values are compared together. With this pairing, you can immediately tell how much a currency is worth in another currency. Often, they are separated by a “/”. But they still mean the same thing if the slash isn’t there.

A perfect example of a currency pair is the GBP/USD.

If you’re confused, don’t worry. Let’s take them one at a time.

What’s a Base Currency?

When you see a pair, the currency that comes first is the base currency. It is the currency that the other currency in the pair is valued against. It’s the one that’s bought or sold for the quote currency.

In the example above, the GBP is the base currency.

What’s a Quote Currency?

This is the second currency that appears in the currency pair and is also known as the ‘counter currency.’ In the example above, the USD is the quote currency.

How Currency Pairs Work

Now that you know the base and quote currencies, let’s tie them together. And to do that, this is the question that every currency pair asks?

“How much of the quote currency do you need to buy the base currency?” So, if you see the GBP/USD pair, you ask yourself, “How much USD (the quote currency) do I need to buy one GBP (the base currency)?

And often, you don’t have to wait too long to get your answer. You’ll often see some prices in front of these currency pairs. These prices are your answer. They’re how much a quote currency will take to buy one piece of the base currency.

So, when GBP/USD has a price of 1.2205, it means it’ll take 1.2205 USD to buy one GBP.

Get it?

Types of Currency Pairs in the Forex Market

There are three categories of currency pairs to trade in the Foreign Exchange market:

- Major currency pairs

- Minor currency pairs

- And exotic pairs.

Let’s see what each category means for forex traders.

Major Currency Pairs

Major currency pairs are those pairs that involve the US dollar and any other major currency. Apart from the USD, the other seven major currencies are:

- British Pound (GBP)

- The Euro (EUR)

- The Japanese Yen (JPY)

- The Canadian Dollar (CAD)

- The Swiss franc (CHF)

- The Australian Dollar (AUD)

- And the New Zealand Dollar (NZD)

So, your major currency pairs would be:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These major pairs make up 61.5% of the entire trading volume in the Forex market. They even have their own nicknames. Check them out below!

Of all these major pairs, the EURUSD is the most widely traded currency pair.

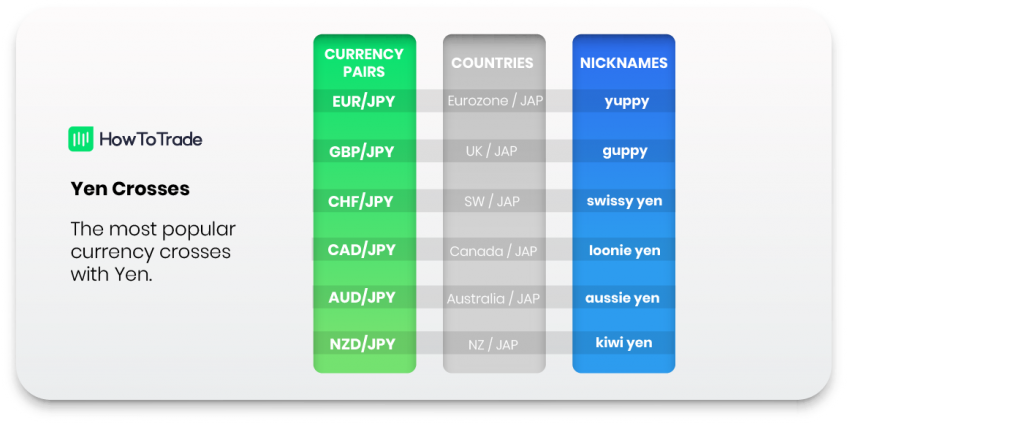

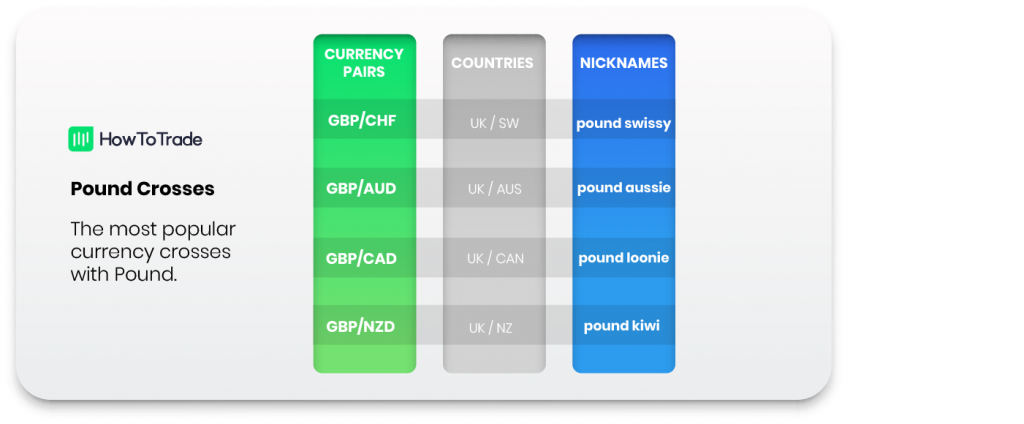

The Crosses or The Minors Currency Pairs

Currency pairs that do NOT include the U.S. dollar (USD) in their pairing are known as cross-currency pairs or simply as crosses. They’re the pairings of the major currencies with one another.

Euro Crosses:

Fun fact: Back in the old days, if someone wanted to change currencies, they would first have to convert their currencies into U.S. dollars, and only then could they convert their dollars into the currency they desired.

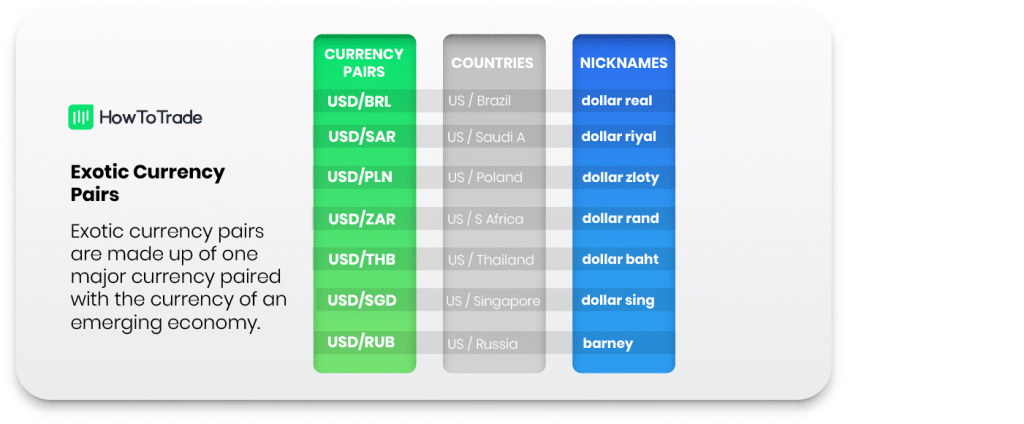

Exotic Forex Currency Pairs

Exotic… you’re probably thinking of exotic countries and exotic belly dancers, but let me stop your imagination there. The label has nothing to do with the location or size of the country (or the number of belly dancers) where the currency is used.

Exotic currency pairs in currency trading are made up of one major currency paired with the currency of an emerging economy, such as Brazil, Mexico, Chile, Turkey, or Hungary. Other currency pairs include EUR/TRY, AUD/NOK, GBP/SEK, and many more.

A benefit to trading exotic currency pairs is that they may offer higher potential returns due to wide price fluctuations. However, this means that trading an exotic currency pair is usually riskier as it has high market volatility and in some cases, heavy involvement from central banks.

The chart below contains a few examples of Exotic forex pairs.

Fun fact: Back in the old days, if someone wanted to change currencies, they would first have to convert their currencies into U.S. dollars, and only then could they convert their dollars into the currency they desired.

Long vs Short Positions in Forex Trading

When trading currency pairs, you’re buying and selling one currency versus the other. As such, if you want to buy a currency (which means buy the base currency and sell the quoted currency), you want the base currency to rise in value and then you would sell it back at a higher price. In other words, you want the value of the Pound to rise against the Dollar.

Let’s assume you have the GBPUSD pair in front of you. Going long on this pair (or buying) means you’re expecting the value of the Pound to rise against the Dollar.

Remember: long = buy.

On the other hand, if you want to sell (which means sell the base currency and buy the quote currency), you want the base currency to fall in value, and then you would buy it back at a lower price.

Simply put, you’re selling British pounds and buying U.S. dollars. You’re hoping the value of the Pound will fall.

This is called ‘going short’ or taking a ‘short position.’

Remember: short = sell.

Unlike most financial markets like the stock market, this is the beauty of the Foreign exchange market. You can easily trade foreign exchange currency pairs in both directions, meaning taking long and short positions. There are no strict margin requirements from your forex broker, and there are more trading opportunities than in other markets. Furthermore, most forex brokers allow you to start buying and selling currency pairs with low initial investment and with the broker’s leverage.

- Currency pairs compare the value of a country’s currency against another.

- It comprises two currencies: a base and a quote currency. The first currency of the pair is called base currency and the second currency is the quote currency.

- The three categories of currency pairs are major, minor, and exotic.

- Of these categories, major currency pairs boast the most abundant trading volume, and exotic pairs are the riskiest to trade.

- When you buy a currency pair, you’re expecting the price of the second currency to rise against the first listed currency. And when you sell, you’re hoping the price of the quote currency falls against the base currency.