Controlling Emotions that Cloud Our Trading judgment

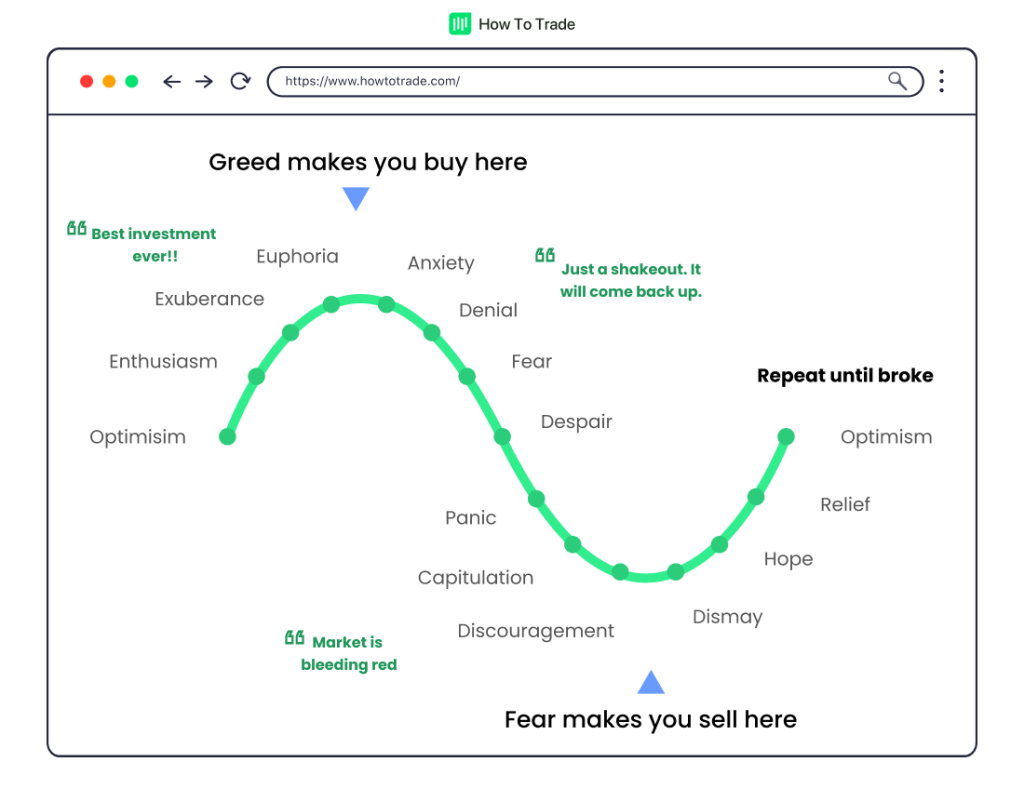

Much like other aspects of daily life, there are sorts of emotions many different traders experience when trading stocks and currency pairs in the market. You see, we all go through similar thinking patterns and emotions as we trade in the forex or stock market, so it’s important we address these trading emotions and learn how we can control them.

And the emotions we are going to discuss in this lesson are of the more dangerous kind because they can cloud your judgment and prevent you from seeing things as they are. These psychological stimuli include euphoria, regret, and stress – and they are usually emotions that relate to a situation in which a trader gets into emotional trading. That is a situation in trading that you do not want to be in…

Trading success – How to avoid emotional trading in financial markets?

For those unaware, emotional trading refers to a situation when a trader lets personal emotions impact money management and decision-making as part of the trader’s trading process. In many opinions, being able to avoid emotional trading is one of the most difficult things in trading and usually differentiates successful traders from failed traders.

So, let’s break down these emotions and see how you can fully understand why some traders fail to overcome and ‘beat’ these negative emotions in trading different markets.

Euphoria

Feeling euphoric is usually a good thing. But when it comes to trading, it classifies as a variety of greed that arises after one has experienced a number of winning trades. It can often lead a trader or investor to become overly confident and enter new unplanned positions, usually in the same direction as the previous winners.

It is for this reason that most traders experience their biggest losing periods right after they scored a couple of winners in the market, and when their trading performance was actually strong. And as the saying goes, after the sunshine the rain begins.

Euphoria has its way of making traders feel like their understanding of the movement of currency pairs is perfect and they found a flawless win-win approach to Forex trading, and predict price movement in financial markets. But in reality, more often than not, it leads to trading errors, unnecessary risk-taking, bad decision-making, and losses leading up to the slippery slope. It can often cripple traders’ trading success, causing them to abandon their trading strategy and go ‘head first’ on the markets without carefully analyzing market behavior and the risks involved in each trade.

So how can you ensure that you won’t fall victim to euphoria?

In trading psychology, many psychologists and top traders believe that the best thing to do is give yourself a break after winning or losing a number of trades and come back to the forex or stock market on another day. This way, you’ll have enough time to process your wins or losses and analyze your peak performance and the decisions that led to them.

It is also super important to remember that even though it is tempting to jump right back in and try to ride the winner’s wave for as long as you can, you gotta remain level-headed and draw a big, fat line between the momentary sensation and reality. Our advice?

When required, allow yourself to feel proud of your temporary trading success, and make sure you remain grounded in your decisions and that every position you enter is preceded by following the steps in your trading plan. This way you will be able to make better decisions, approach every trade with a clear and level perspective, and ultimately become a profitable trader in the long run.

Regret

Regret, also referred to by trading psychologists as the “fear of missing out” (FOMO) often pushes traders to enter into positions, even after the window of opportunity has already closed. I mean.. let’s be honest, we’re all guilty of this. Not only in trading but in life as well. Personally, I may have done it once or twice…….

Regret in trading psychology can often act as a demotivation factor, instilling doubt in one’s mind, blurring their trading judgment, and eventually leading to frustration and the potential end of an individual trading career. Why? Because regret creates the perfect combination of fear and greed and when that happens, you lose your strategy, the ability to correctly research the markets, and stay flexible in your decision making.

The key to dealing with regret is to maintain your trading discipline, follow your strategy, and know that there are other (perhaps even better) opportunities out there. Just like a chartered market technician, you need to be technical to succeed and forget the previous trade. And remember, even if you’d missed out on an opportunity, don’t let it bring you down. Get back to the market and analyze it with a fresh pair of eyes without considering the burden of the past trades. Easier said than done but still…

Stress

There are times in our lives when events beyond our control affect our ability to think clearly. It could be anything from stress at your work to stress at home or illness… There’s no factor too small. And all these things causing you stress can cloud your trading judgment and distract you from trading and making profits.

So if you’re going through a stressful period, it’s often safest to put your trading on hold until you can commit the necessary time and energy to it again. That’s what successful traders usually do. They put their trading on the side while clearing their mind.

After all, the changing nature of the market price action is stressful and demanding enough, especially if you are involved in day trading. You can always get back to it once you are ready to give it your undivided attention again and you feel you have positive trading psychology.

The Bottom Line

The key takeaways for you from this lesson should be that you need to know how these emotions play a significant role in your trading performance and can lead to situations when you act irrationally. Also, you need to understand that trading psychology is not really just one thing. It is a set of tools and practices that make the perfect trading plan for you. Good traders and investors know how to control emotions and how to forget bad trades.

Remember, trading psychology is not seen as the most important aspect of trading and many traders focus on technical analysis tools rather than improving their trading psychology skills. But frankly, that could be the one thing that will lead you to become a successful trader or not.

To increase your knowledge about trading psychology, we recommend this popular trading book by Brett N. Steenbarger – the Daily Trading Coach. Another popular book about trading psychology includes Trading in the Zone by Mark Douglas.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."