What is The Cycle of Doom in Forex?

Looking back to when I first started trading various assets in the financial markets… well, it was an experience and a half, to say the least. One day I thought I was the best trader to have ever existed, and the next I never wanted to look at the stupid chart again after making a series of fatal forex mistakes that led to losing trades and the vicious cycle of doom.

It was an emotional rollercoaster and it is needless to say that the money was going out much faster than coming in. My Forex game was comical. An absolute disaster. But don’t get me wrong, I didn’t think so then, I only do now. Every time I lost a good trade, I went and got a new ’’better ’’ trading strategy to ‘making money’.

On a couple of occasions, I even paid for them. Yup, I did. And then I got overly optimistic, naive, wasted more money, and went back to square one. Or in other words, I had fallen victim to the Cycle of Doom. So, for all the beginner forex traders out there – let me at least help you try to avoid a ‘trader’s doom’…

What is the Cycle of Doom in the Forex Market?

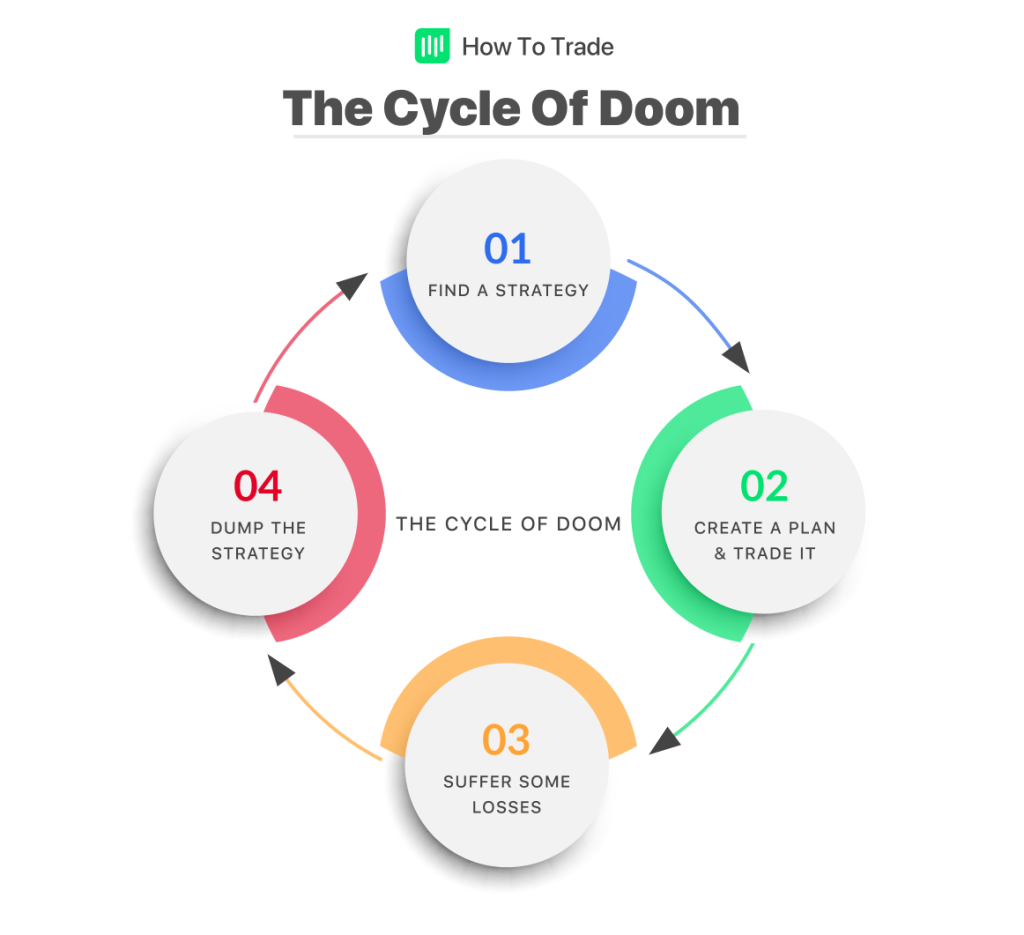

Simply put, the Cycle of Doom can be described as a stage in one’s trading career where Forex professional traders start being profitable using their own strategy, followed by big losses leading them to abandon their strategies and consequently search for a better trading system.

Let’s say it’s you going through the Cycle of Doom. You got yourself a strategy. It doesn’t matter whether you created it yourself, copied it, found it online, or bought it from a farmer in India. You pull the trigger and off the bat, you win a trade. And then you win another one. And the one after that! You succeed in making consistent profits and can you call yourself a successful trader now. Things are going G.R.E.A.T !!!

What happens next? The wins are replaced by losses and you start losing money instead of making profits. A lot of them. And the problem? YOUR STRATEGY FOR SURE….. right??? You start panicking and decide it’s time to tweak and optimize it. You add some minor changes here and there and off you go again, with a ‘better, more reliable strategy’.

Next, you win a couple of trades before you’re hit by the losses… Time to adjust the strategy again? Yup! The same thing happens and eventually, after tweaking it hundreds of times, it’s time to get a brand new strategy to replace the old one. And then you go round and round the circle, or as we call it in Forex, the Cycle of Doom. It happens to many traders and in particular many beginner forex traders.

Changing trading strategies and finding different forex signals in the hope that you’ll find the Holy Grail. Well, guess what, it doesn’t exist!

Overcoming the vicious Cycle of doom in forex trading

Let’s state the obvious. You are in the Forex market to make money. And if you are planning to actually make a full time trading career as a trader, you need to know how to develop a consistent profit trading system. And there’s absolutely no chance you will become a consistently profitable trader if you change strategies every time a forex trade goes against you.

If anything, this is a great way to burn through your capital. In order to make money, you need to have a good trading strategy and a risk management plan stick with it! It is super mega important you’re confident in your strategy, even if it goes against you sometimes.

And if you’re not confident in your strategy? Backtest it! Seriously, fully backtest it to find the right way for you to place good trades and gain confidence. Put it through all the historical market information data and properly determine what works and what doesn’t.

Remember, there is no such thing as a perfect trading strategy… even if online ‘gurus’ trading from the beach tell you so. You will stumble upon some losses along the way but before you go changing it up, ensure you always ask yourself WWALD.

HowToTrade.com is always there to help you, as well as our fantastic mentors and fellow traders. Meanwhile, in the next course, we are going to learn how different financial assets affect currency pairs’ prices.