Trading With Three Time Frames

We prefer using three time frames to craft our forex trading decisions. By doing so, we feel that we have the most flexibility to catch the short-, medium-, and long-term trends.

In a nutshell, we think that multiple time frame analysis is one of the best ways to build a robust trading style. And why not? A lot of forex day traders around the globe use multiple time frames to craft consistently strong trading decisions. Keep reading to learn more about this powerful trading methodology.

What is Multiple Time Frame Analysis?

Multi time frame analysis is a form of technical analysis where one refers to at least two charts with different periodicities. Typically, traders work long to short and decide which time frame is ideal for analytics as well as identifying market entry.

One of the great things about trading multiple time frames is the ease by which one can identify a market’s state. Whether the price is trending or stagnating, we can readily ascertain the prevailing market conditions and tailor our strategy accordingly. That way, we can take trades that are in the same direction as the broader market.

Without a doubt, multiple-time frame analysis is a powerful trading tool. Read on to learn how we use it, step-by-step.

Rule 1: Determine the Main Trend

The largest time frame we consider our primary trend. Why? Well, by getting a bird-eye view, we can spot the macro trend and build our trading decisions accordingly. In other words, we can get a clear view of the big picture regarding the currency pair we want to trade.

For example, on the daily chart, let’s say that the EUR/USD is trading above the 200 SMA. Although general, this bit of information tells us that the main trend is UP. This is inherently useful information as we can begin looking to take long trades in the EUR/USD using intraday time frames to define the market entry.

Always remember, when using multiple time frames, we work long to short to identify pricing trends. So, you can begin with yearly, weekly, or monthly charts before going to daily and intraday time frames. In doing so, it’s very possible to find great trade setups in concert with the broader trend.

Rule 2: Determine Current Market Bias

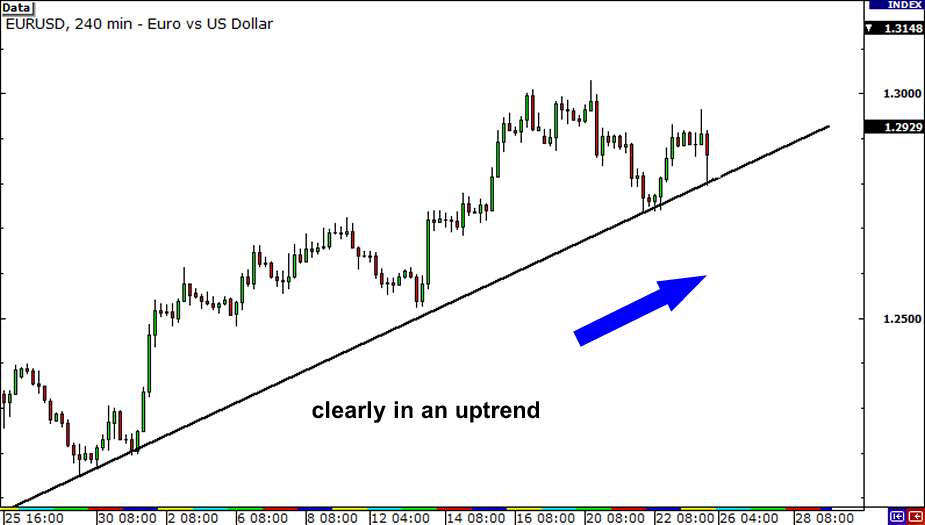

Next, we look at the second-largest time frame. This signals to us the medium-term buy or sell bias. Below is a 4-hour chart, and we can clearly see that EUR/USD continues to have a bullish bias.

As you can see from this intraday timeframe, price action is moving in concert with the broader trend. Not only does this information confirm our bullish bias, but it may give us a strong signal to enter the market. For all intents and purposes, this type of technical analysis is an outstanding way to build positive expectation trading strategies.

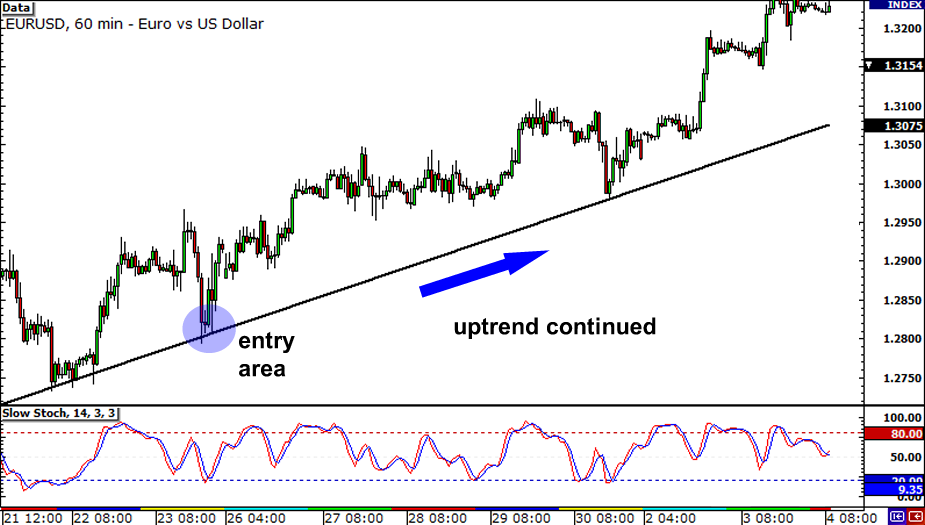

Rule 3: Determine Entry and Exit

In multi-timeframe analysis, we use the smallest time frame to determine the short-term trend and find good entry and exit points. Although finding solid entry and exit points can be a challenge, the shorter time frame charts allow us to manage our risk exposure with precision.

That is the idea behind viewing price movement on different time frames; to maximize our opportunity while keeping risk in check!

What is the Best Combination of Multiple Time Frames?

There are no set rules on what time frames one can combine just as long as there is enough time difference between them to see a discrepancy in their movement.

If the time frames are too close, you will not be able to tell the difference and so there would be no point in using three different time frames. It’s crucial that you select time frames that provide a diverse collection of information. It simply doesn’t help to compare a 1-minute time frame to a 90-second time frame; there simply isn’t enough discrepancy between the two!

Below are examples of different time frames you might use for your trading strategy. Each progression of time frames can be used to build more informed trading decisions in the live market:

- 1-minute, 5-minute, and 30-minute

- 5-minute, 30-minute, and 4-hour

- 15-minute, 1-hour, and 4-hour

- 1-hour, 4-hour, and daily

- 4-hour, daily, and weekly and so on.

Remember, you don’t need to only choose a one-time frame and stick with it. You are free to change time frames and mix and match until you find a workable strategy. In this way, you can find exactly which trading time frame is best suited for your personality, style, and objectives.

In fact, we would strongly advise you to try out different time frames through different market environments, record your results, and analyze your findings to learn exactly what works for you.

Make sure there is enough difference for the smaller time frame to move back and forth without every move reflecting in the larger time frame.

Trading multiple time frames is another amazing thing to add to your Forex trading toolbox! When coupled with other tools and technical indicators, you are ready to trade your favorite currency pair and join the ranks of successful day traders.

Our advice?

IMPORTANT: Make it a habit to look at multiple time frames when trading. It’s a great way to approach the market from a structured, disciplined perspective.

Trading 3 Time Frames is a Great Way to Approach the Forex Market

A good, strong trading strategy is one that allows you to safely pursue profitability in the live market. Trading on multiple time frames is exactly that and can be a foundational element for any trader.

By using multiple time frames to engage the market, you are free to focus on trade management in accordance with the dominant trend. You also get to have a top down approach to trading.

Key Takeaways

- Using multiple time frames in Forex trading, such as short-, medium-, and long-term, enhances flexibility and trend identification, forming a robust trading style.

- The largest time frame is used to identify the primary trend, providing a macro view that guides overall trading decisions.

- The second-largest time frame helps determine the medium-term market bias, which aligns trades with the broader trend and confirms entry signals.

- The smallest time frame is crucial for pinpointing precise entry and exit points, effectively managing risk exposure.

- Traders should experiment with different timeframe combinations to find what suits their style best, while ensuring enough discrepancy between them for effective analysis.

As with most things forex, it’s imperative to be consistent when analyzing the markets on multiple time frames. Be sure to stick to your rules and study your past performance. If you do, then it’s only a matter of time before your best time frame presents itself!

On to the next lesson!