How To Calculate Stock Return (4 Stock Return Formulas)

Now, everything in the stock market boils down to one thing – profits.

Or, in other words, generating a reasonable rate of return! But how do you calculate returns on your stock investments? What’s the stock return formula, and how can you use it to make better investment decisions?

- Calculating stock returns is fundamental for understanding your investment’s performance.

- Using the essential formulas and methods for determining returns on stock investments will create more accurate calculations

- Mastering the calculation of Return on Investment (ROI) provides a clear view of your stock’s actual growth and potential.

Whether you decide to use these formulas to calculate your stock’s daily return or the net return for future results, knowing how to calculate stock return is a tool you need to add to your arsenal. This lesson will cover the basics of calculating return on stock investments.

4 most common ways on how to calculate stock return:

4 most common ways on how to calculate stock return:

What Is Return on Investment (ROI)?

Return on investment, or ROI in short, is an investment performance measure used to evaluate the returns of an investment.

The ROI is generally expressed as a percentage or ratio and provides investors with a way to evaluate and compare assets or financial instruments. For example, a company with an ROI of 7% offers investors an annual return of 7% on their investment.

How Do You Calculate Return on Investment?

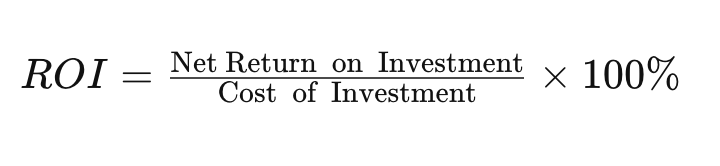

The first and most basic method to calculate a stock’s total return on investment is:

This means that you have invested $1000 in Tesla stock (stock ticker TSLA), and the Tesla share price has jumped 10% in the previous year; you will now have $1100 in your account. Meaning the ROI is 10%.

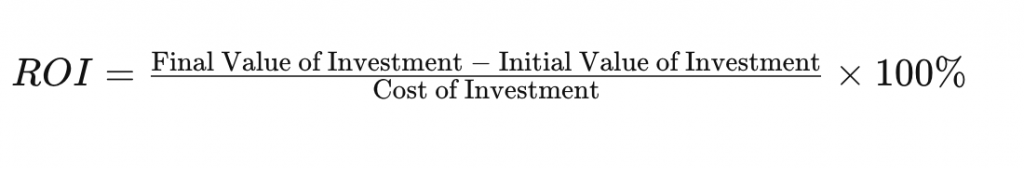

The other popular method amongst investors to calculate return on investment is:

However, when it comes to calculating ROI on a stock investment, the formula gets slightly more complicated. This is because the formula tries to capture the value of money over time, so you’ll have to consider other factors. For example, if you are buying dividend-paying stocks, you’ll have to include the dividends paid into your ROI.

There are several different formulas to calculate the investment returns on your shares, depending on the nature of your investments, and the type of stock you are buying. We will cover the most popular ones below.

Total Stock Return

What Are Total Returns in The Stock Market?

Total returns measure the overall profit earned from all sources, including dividends paid, interests, and other capital gains over a set period of time. Generally, total returns are expressed in the form of percentages.

How Can You Calculate Total Returns?

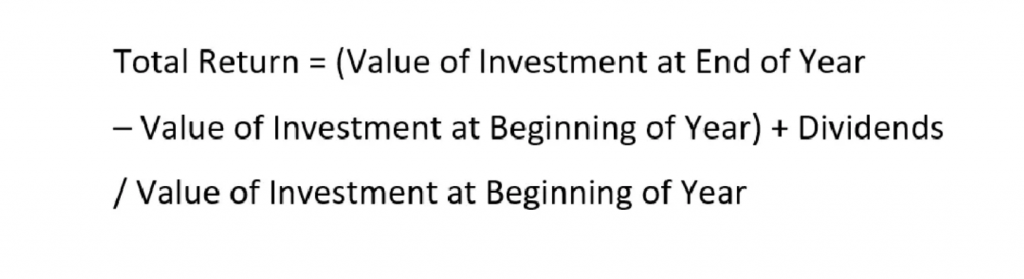

Calculating your Total Returns is simple, but remember to include all applicable metrics (e.g., dividends). The total stock return formula goes as follows:

Now, let’s talk examples. Let’s say you bought a Stock for $8,200, and now it is worth $9,300, making you a beautiful $1,100. Let’s also assume that you received dividends throughout this time with a total value of $400.

Now, let’s calculate the total returns on your investments. Firstly, we will subtract the total value of the stock at the start of the year from the value at the end.

In our case, the stock was worth $8,200 at the start and $9,300 at the end, which means that the stock gained $1,100 in value. This is also called an unrealized gain.

Next, Add any dividends you received throughout the year to the unrealized gain to find your net profit for the year. In our case, you had an unrealized gain of $1,100 and received $400 in dividends; therefore, your net gain for the year was $1,500.

Lastly, you need to divide the net gain or loss by the total value of the stock at the start of the year to calculate the return on the stock. In our case, the stock was worth $8,200 at the beginning of the year, and you have a net gain of $1,500, so you have $1,500 / $8,200 = 0.183. Multiply this by 100 to convert it to a percentage. The return on the stock is 18.3 percent.

This is what the calculations would look like for math lovers out there.

- ($9,300- $8,200) + $400 / $8,200

- $1,100 + $400 / $8,200

- $1,500 / $8,200

- 0.183 x 100

- 18.3%

Simple Stock Return

What Are Simple Returns in The Stocks Market?

Simple returns are super similar to total returns; however, they are generally used to calculate returns on investments after they have been sold. Typically, simple returns are expressed in the form of percentages of the stock data.

How Can You Calculate Simple Returns?

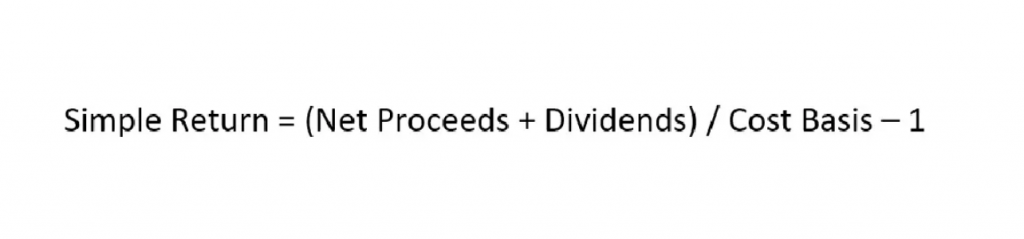

Here is the simple stock return formula goes like this:

Let’s talk examples again.

Say you bought a stock for $2,000 and paid a $20 commission. Your cost basis would be $2,020. Now, let’s say you are ready to sell your shares at a closing price of $3,000 (with a $20 commission again). Your net proceeds would therefore be $2,980.

For this example, let’s also assume that your dividends were $150. This is how you would calculate your Simple Returns.

- $2980 + 150 ÷ $2,020 -1

- 3130 ÷ $2,020 -1

- 1.549 – 1

- 0.549

- 54.9%

In our example, your simple net dollar return would be 0.54 or 54%. Pretty simple, right?

Compound Annual Growth Rate

What Is the Compound Annual Growth Rate?

The Compound Annual Growth Rate (CAGR) measures the value of money in your investment over a long period (more than one year period).

How Can You Calculate the Compound Annual Growth Rate?

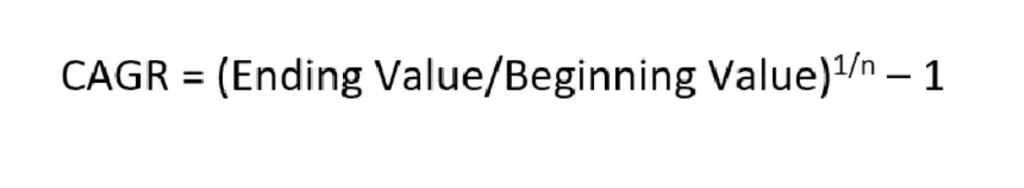

Calculating the CAGR is a little more complex than our previously mentioned methods. The formula goes as follows:

As you’ve probably noticed, we love an example, and we wouldn’t leave you without one for the CAGR method.

So, let’s say you are an investor looking to buy 250 shares of a stock trading on the stock market for a purchase price of $60 per share. Therefore, your initial investment (and initial value) is $15,000. You are looking to leave it untouched for at least five years.

Now, to calculate the compound annual growth rate, you will need the ending balance, the starting balance, and the time period, in our case, the number of years. Therefore, the ending value of the investment, divided by the beginning value, is raised to the power of the reciprocal of the time duration of the investment, which in this case, is five years.

For this example, we will say that the stock has risen to $110 per share in the past five years. This means that its worth is now $27,500.

($27,500 / $15,000 ^ ¼ ) change to 5

Next, we subtract 1, and multiply by 100% to see its value as a percentage:

($27,500 / $15,000 ^ ¼ )- 1 = 0.2033

0.2033 x 100% = 20,33%

As you can see, the Compound Annual Growth Rate for your stock is 20,33%.

Over to You

In summary, investors use these three main methods to calculate their profits (or losses), and effectively manage their personal finance. Obviously, you can use an online stock calculator to calculate your annualized return but knowing how to calculate stock return could be an extremely valuable tool for your financial freedom.

If you haven’t invested in stocks yet, keep these methods in the back of your mind for now, and you can always return to them later after you have bought a certain stock. You might end up choosing one of the methods to calculate your returns, or you might end up using all three of them.

Ultimately, it all comes down to the type of trader you are and how you choose to invest. Oh, and if you don’t want to do the calculations yourself, you can always use the stock total return calculator here.

See you in the next lesson!