How Does The Stock Market Affect Forex?

As a forex trader, you spend a lot of your time looking at fundamental and technical analysis. But, have you ever come across traders who also keep an eye on the stock market? Have you watched as they scrutinize stock prices while trading the EUR/USD?

Well, there are more than a few of these characters inside our Trading Room. And, guess what? They aren’t wrong. In many cases, currency pairs on the foreign exchange market exhibit sensitivity to stock performance.

In this lesson, we will explore the reasons why many traders consider there to be a connection between the stock and forex markets.

The Stock Market and Stock Prices

For traders not familiar with the stock market, it can be defined as a place where investors buy and sell shares (stocks) in public organizations. Two of the most prominent are the NYSE in the US and the LSE UK stock market.

At the end of the day, a stock market is a place where companies like Microsoft sell small pieces of themselves to shareholders. The goal of such sales is to raise money for inventing new products, building new factories, expanding to emerging markets, or hiring more people. And, anyone including you, me, your gran, or foreign investors can buy those pieces.

When you purchase stock in a company, you become a part-owner. Thus, when a company in the stock market makes money, everyone who owns a piece of that company profits too. In turn, the market value of the shares rises, contributing to the net worth of the investors.

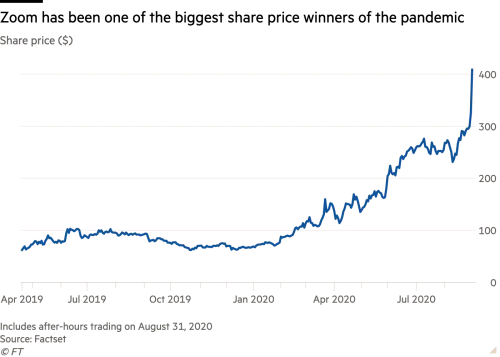

For example, you may have heard of people buying Zoom stock at the beginning of the pandemic and their accounts blowing through the roof a couple of months later. If you missed the action, here’s a graph of what happened with Zoom throughout the global COVID-19 pandemic.

With that said, the stock market, just like forex is all about strategy, analysis, and astute timing. As with exchange rate fluctuations, you profit from owning stocks when the share price increases and lose when the price of your shares drops.

Now that you understand what the stock market is and how it works, let’s explore what a stock index is and how stock prices react to market underpinnings. Then, you will be able to understand how and when the stock and forex markets correlate.

What is a Stock Index?

A stock index is a measurement of a section of the stock market. Generally, it shows the weighted price average of your chosen stock and can be classified in a number of ways.

- World index – This includes stocks from all around the world.

- National index – This represents the stocks of a nation.

- Regional index – This includes local companies within certain regions.

With that out the way, let’s talk a bit about a few of the leading indices in the world of finance.

Stock Markets, Equities Indices, and the Forex Market

As a general rule, traders and investors view stock indices as being a benchmark of aggregate market performance. This is a key point when attempting to establish correlations between currency movements and stock market behavior.

Below are a few of the leading markets and indices in the world:

- New York Stock Exchange (NYSE): Dow Jones Industrial Average (DJIA) and S&P 500

- NASDAQ (NASDAQ): NASDAQ Composite, NASDAQ 100

- London Stock Exchange (LSE): FTSE 100

- Tokyo Stock Exchange (TSE): Nikkei 225

NIKKEI 225 (Japan)

The Nikkei 225 is the most popular index in the Japanese stock market. As in the name, it encompasses 225 of the leading companies in Japan. Nikkei 225 components include organizations such as Honda, Mitsubishi, Toyota, and Sony.

It is currently the most widely quoted average of the Japanese stock market. You can find the full list here.

Correlations between the Nikkei and USD/JPY

Nikkei and USD/JPY have been showing a strong correlation for many years now. This phenomenon may be attributed to a number of factors that relate to the Japanese yen (JPY) being Japan’s domestic currency. Thus, the USD/JPY has a tendency of reflecting Japan’s economic prowess in comparison to the world’s reserve currency (USD).

For example, before the economic recession in 2007, when economies around the world experienced countless months of negative GDP growth, the Nikkei 225 and the USD/JPY were inversely correlated. Basically, traders and investors believed that the Nikkei stock market was a good reflection of the economic state of the country.

So, if the Nikkei 225 were to rally then it would lead to national currency strengthening and an uptick in the yen. Therefore, the USD/JPY exchange rate was in a position to drop.

The correlation also worked in the opposite direction. Whenever the Nikkei would drop, the value of the yen would weaken against other currencies; thus, the USD/JPY would rise.

However, after the financial crisis of 2008, the correlation between the Nikkei and USD/JPY went crazy. While the yen didn’t act autonomously, USD/JPY exchange rates did shift fundamentally. They no longer moved oppositely, but instead, they began moving in the same direction. Just take a look at the image below.

Incredible, right? And, that’s just one example of how stocks and the forex market correlate.

The Dow Jones Industrial Average (DOW, US)

The Dow Jones Industrial Average (Dow) is the caviar of the stock market. It’s one of the most notable and premier indexes traded in the world today. Also, the DOW is widely used to determine the industrial performance of the US economy.

The DOW has 30 components and tracks the price movements of the 30 largest and most influential American companies in the stock market. These include Disney, Coca-Cola, Boeing, McDonald’s, Microsoft, and many more. You can see the full list here.

At a fundamental level, the DOW does have an impact on the country’s currency, the U.S. dollar. A large portion of this correlation may be directly attributed to pending policy decisions from the U.S. Federal Reserve (Fed).

Correlations between the Dow and USD

The strength or weakness of the USD has an impact on the United States stock market, especially stocks of BIG worldwide companies.

For large U.S. companies that market products around the Globe, a rising U.S. dollar can put a dent in the profits. This is due to the pressure put on the export sector and the cost of marketing goods abroad. While not the only underpinning of the USD, the import/export dichotomy is a premier forex market driver.

Broadly speaking, if the USD is strong versus other currencies, the export sector suffers. On the other hand, a devalued USD can lead to an uptick in economic activity. So it goes when examining the intricacies of the world’s reserve currency!

Understanding How Stock Market Affects Currencies

As a trader, it’s always beneficial to look for correlations between other financial markets. While it’s not the end all be all to forex trading, correlations can give us insight into the movements of exchange rates.

And, fortunately for active foreign exchange traders, these correlations can effectively indicate forthcoming price action. This is incredibly useful information when it comes to crafting trading decisions.

However, it’s crucial that you remember correlations are not a sure thing and shouldn’t be taken for granted. As with all things in forex trading, change is the only constant!