How Does Oil Affect The Forex Market?

Let’s talk about black gold. You may also know it as Texas Tea, the lifeblood of the industry, or by its formal name: crude oil.

Crude oil is the world’s most heavily traded commodity and the backbone of some of the largest global economic powers. It has always had a massive impact on many aspects of finance, including forex. Depending upon the performance of the energy markets, oil is estimated to be worth just over $4 trillion in annual revenues, not accounting for the economic growth spurred by its cultivation and consumption.

How Does Oil Affect Fiat Currencies?

Given its epic market value, it should come as no surprise that oil significantly impacts areas beyond the energy market. One of its most influential arenas is within the global currency trade.

All oil correlations are based on the two leading types of crude oil:

- North Sea Brent (Brent, UKOIL)

- West Texas Intermediate (WTI, USOIL)

Many of the global majors are directly impacted by Brent and WTI crude oil prices. For instance, the Canadian dollar derives a good portion of its value from a positive correlation with the WTI oil price.

Also, the USD is used to price both WTI and Brent, so higher crude prices suggest a weaker USD. Even the British pound and euro will exhibit periodic sensitivities to the pricing of North Sea Brent.

In addition to its influence on the majors, global crude oil prices can profoundly impact the performance of emerging markets. While falling commodity prices can help first-world economies grow, they can be devastating to producers. This is no different for oil, where many countries that rely on the energy sector are classified as developing economies.

Impact of Oil Exports on Economies

One of the most evident correlations between oil and other markets is in nations producing and exporting oil as a major part of their economy. These nations are mega-dependent on high oil prices because a potential collapse could erode the value of their national currency.

For these countries, falling commodity prices, specifically in oil, can destroy economic progress. And nobody wants that.

Let’s take OPEC leader Saudi Arabia as an example. If their oil exports were to collapse for whatever reason, the Saudi riyal’s value would drastically decrease as the country is super dependent on its revenue from oil. This means that the European Central Bank (ECB) or really anyone could stockpile the riyal for a fraction of its worth, all because the current oil price took a nosedive.

However, Saudi Arabia is not the only country dependent on the oil industry. We have attached a list of the largest oil producers worldwide below.

FUN FACT: A barrel of oil is priced in USD worldwide. When the USD is strong, buying one barrel of crude oil costs less. When the USD is weak, oil prices are higher in dollars.

Oil Prices and the U.S. Dollar (USD)

Many financial experts worldwide believe the U.S. dollar is becoming a Petrol currency. This is a moniker given to currencies of nations such as Russia, Canada, or Norway, where profits from exporting oil make up a considerable part of their overall economy.

The price of oil is related to the price of the US dollar. In fact, referencing the price of crude oil is a popular USD trading proxy. Forex traders rarely miss such a fascinating correlation!

The Correlation Between Crude Oil and Currency Pairs

But what about currency pairs? Well, they have correlations too! In fact, one of the most famous is how the Loonie (aka the Canadian dollar) and oil interact with one another.

Let’s take a closer look at the USD/CAD currency pair and why forex experts believe it strongly correlates with oil prices.

Crude Oil vs the USD/CAD

Did you know that Canada exports more than 3 billion barrels of oil to the U.S. every day? This makes Canada the largest oil supplier to the United States and the U.S. the largest oil dealer out there.

Now, due to the volumes involved, this creates a massive amount of demand for the Canadian dollar (CAD). And, because of the brisk demand, the USD/CAD is super vulnerable to how consumers in the United States react to changes in oil prices. That’s why the CAD is known as a “commodity dollar;” it is tied to commodity pricing. Other commodity dollars are the Australian dollar (gold) and the New Zealand dollar (dairy products).

Let’s talk examples.

If the demand for oil in the United States increases, manufacturers will need to order more oil to keep up with the increasing demand. This can then lead to a rise in oil pricing, which may lead to a fall in USD/CAD. This was certainly the case during oil’s last bull market cycle of 2021.

If the demand in the United States decreases, manufacturers may decide to slow down with the oil orders, which may effectively hurt demand for the CAD. According to this scenario, currency traders may forego the CAD in the belief that crude oil peaked.

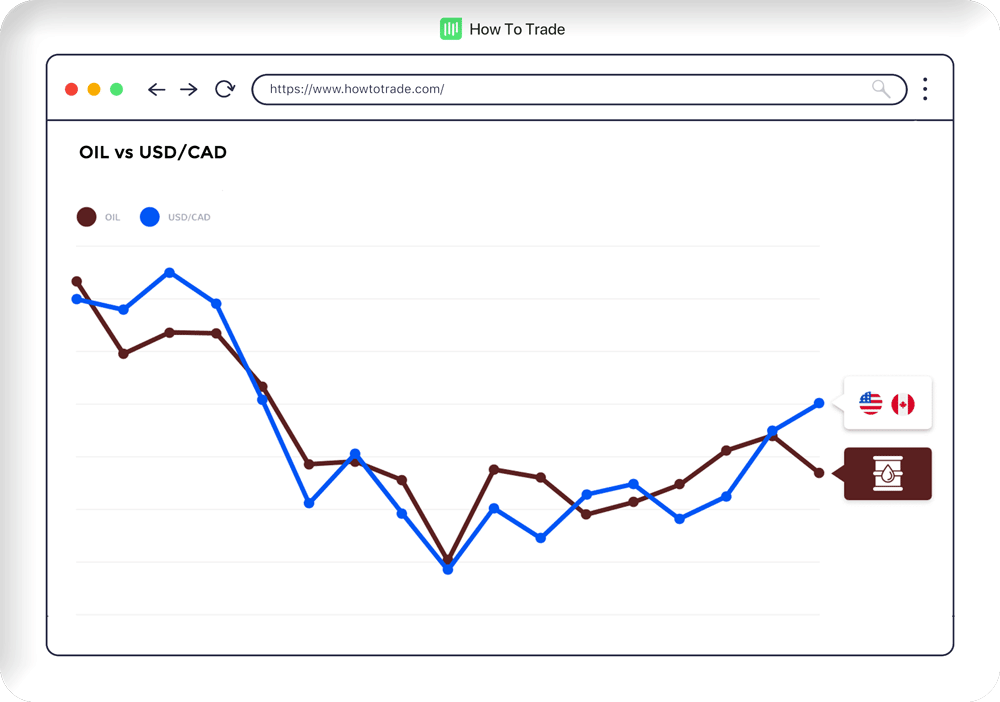

You can clearly see that oil has had a negative correlation with USD/CAD. Why? Because when the price of oil rises, the relative value of the CAD does as well. Thus, the USD loses value versus the CAD.

This relationship has been evident since 2000, and it was especially visible from 2000 to 2016, when it was 93% negative. During this period, any U.S. dollar index bullish fund that bet against the Loonie struggled mightily.

To review, when the value of oil increases, the USD/CAD falls. And, when the oil price falls, the USD/CAD increases.

Look at the chart below to see what it looks like on a side-by-side chart.

So, the next time you’re topping up your car and you see the oil prices rising, it may be the right time to go short on USD/CAD. Or at least fill up your tank and lock in the current price!

Even if you don’t want to place a trade, have a look at that USD/CAD chart to see if the negative correlation is still there. We bet it will be, in one form or another!

Key Takeaways

- Oil prices have a strong impact on the value of currencies, particularly those of countries that produce and export oil.

- The price of oil is negatively correlated with the U.S. dollar. In other words, when oil prices rise, the U.S. dollar tends to fall, and vice versa.

- The USD/CAD currency pair is particularly sensitive to changes in oil prices, as Canada is a major oil exporter to the United States. When oil prices rise, the CAD tends to strengthen, and when oil prices fall, the CAD tends to weaken.

Global Oil Prices Are a Key Forex Market Driver

There is no denying that oil is one of the most important commodities worldwide. In the coming decades, it will undoubtedly continue to shape economic trends. Whether you are trading the CAD, USD, the Australian dollar, or Russian rubles, be sure to keep an eye on crude oil.