Does the Bond Market Affect Forex?

Bonds are a form of debt instrument used by large companies, governments, and multinational organizations. By issuing these fixed-income debt securities, they can simply borrow funds in return for a fixed rate on their principal.

According to many opinions, the bond market is by far the most important in the financial system because of its role in helping financial organizations raise funds and being such a vital tool for government financing. And there’s a strong correlation between the bond market and the Foreign exchange market. Usually, the bond market is a leading indicator of Forex currency movements and vice versa. So, let’s explore this and see why you may rely on government bonds’ prices (or yields) to predict price movements in the currency market.

What Are Bond Yields?

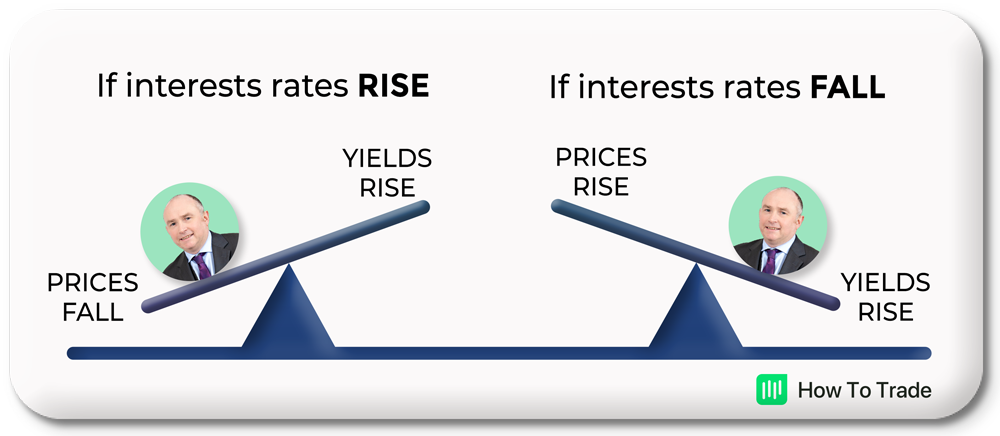

Bond yield is the interest paid to the bondholder after the maturity period, while the bond price is the sum of money the bondholder pays for the actual bond. It is important to note that bond prices and bond yields are inversely correlated. This, therefore, means that bond yields fall when bond prices rise, and bond yields rise when bond prices rise.

Below is a mini illustration to help you remember this inverse correlation.

Let’s say you own a government bond. If the government has taken a bond, essentially, it borrowed money from you. Now, you might be thinking it sounds pretty similar to stocks. The main difference is that when you borrow a bond, you will have a predetermined set date by which you need to pay the money back.

This will usually consist of payments at a specified rate of return, also known as the bond yield, at certain time intervals. These payments are also known as coupon payments, which are the annual interest rate paid on any type of bond. However, remember that the forex market is correlated with the government bonds market and not with the corporate bonds market.

The bond yield on a government bond is the interest rate set by the nation’s central bank that the government is willing to pay you for lending money to the government. Generally, government bonds are considered a safe type of investment and, therefore, tend to have lower yields.

But that also depends on the country. If you lend money to a developed, stable country like the United States, you’ll obviously get a lower bond yield than lending money to a less stable country like Argentina (1.41% on 10-year government bonds in the US and 51.71% on 10-year government bonds in Argentina, according to Statista).

The Relationship Between Stock Prices, Bond Prices, and the Foreign Exchange Market

Bond yields indicate the strength of a specific country’s stock market, which typically increases the demand for the country’s currency. For instance, the United States bond yields gauge the performance of the United States stock market and, therefore, reflect the demand for USD. Let’s talk examples.

The truth is that the bond market and the stock market are in competition. The demand for bonds generally rises when the stock market becomes riskier. The uncertainty in the stock market drives bond prices higher and, by virtue of their inverse relationship, pushes bond yields down. As more and more traders sail away from stocks and other risky investments, increased demand for ‘less risky instruments’ like U.S. bonds and the safe-haven USD pushes their prices UP. In such a scenario, when US government bond yields decline, the value of the US Dollar rises in relation to other currencies.

However, you need to remember that there’s another side to the story. If the stock market falls and bond prices increase, bond yields decline, and fewer investors will buy the country’s bonds and thus the country’s currency. In this case, there’s a slowdown in economic activity, and central banks typically lower interest rates to encourage spending. A low interest rate means investors sell the currency until the central bank raises rates when economic growth is back on track.

So, considering the above, you’ll have to figure out the market sentiment and which one of the scenarios is the one that is happening. No one promised it was going to be easy, right?

What Are Bond Spreads and How Do Bond Yields Affect Currency Prices?

Now, let’s get to the core of this article and talk about bonds relative to the Foreign exchange market and how bond yields affect currencies. First, a bond spread can be defined as the difference between two countries’ bond yields or interest rate differential.

By monitoring these bond spreads and interest rate differential, traders can understand where currency pair exchange rates are headed due to the carry trade strategy in forex trading used by governments, large institutions, and foreign investors. Once the yield of a certain bond is higher relative to other assets, investors are attracted to buy these bonds, and as such, they must purchase the local currency.

So, simply put, everybody’s looking for higher bond yields (and safe investment) – meaning bond yields and currency exchange rates will always move in the same direction. And, much like national currencies, bond yields are affected by a country’s monetary policy and interest rate expectations.

These government bonds have a central role in the value of a currency because their issuance increases the debt of the country. Further, because bond yields fluctuate more with interest rates expectations and market sentiment, you need to follow economic data and central bank policies.

Key Takeaways

- Bond yields are affected by a country’s monetary policy and interest rate expectations.

- To find trading opportunities, traders should monitor bond spreads and interest rate differentials.

- When yields are higher in one country relative to others, the currency of that country will tend to appreciate.

- When yields fall in one country relative to others, the currency of that country will tend to depreciate.

Final Words

We know that if this was your first time hearing about a bond yield and its effect on currency pairs, it might have seemed pretty confusing. But don’t let this put you off! Just like with everything else, it gets easier in time! What you need to do is simply add the actual bond yield of the currencies you are trading to your watchlist.

For example, if you are trading the USD/JPY, you need to add Japanese bond yields and US treasury bonds (look at the 10-year bonds) and check the yield differential between the two bonds. This will help you find lots of trading opportunities by analyzing where the bond yield differential moves.

That’s it. There’s no trading strategy or a fancy indicator here. You just need to keep your eyes open on countries’ bond yields. Then, if you notice that a country’s bond yields increase relative to others, there’s your trade or long-term carry trade position.

In the next lesson, we’ll learn about silver and its impact on the Foreign exchange market.