As of today, EUR/USD trades at 1.07401 with minimal change, influenced by French legislative election uncertainty.

Key Points

- EUR/USD closed at 1.07392 with a 0.05% gain amid mixed data and European political uncertainty.

- The U.S. dollar weakened on weak retail sales but regained some strength due to European concerns.

- Political developments in Europe and potential fiscal instability drive EUR/USD sentiment.

EUR/USD Daily Price Analysis – 19/06/2024

The EUR/USD pair closed at 1.07392 on Tuesday, opening at 1.07338, resulting in a marginal gain of 0.05%. This slight increase came amidst a backdrop of mixed economic data and political uncertainty in Europe. The U.S. dollar experienced downward pressure due to weak U.S. retail sales data for May, which showed minimal growth and downward revisions for April. This weak data led to increased bets on a potential rate cut by the Federal Reserve later in the year, which initially weakened the dollar but it regained some ground due to ongoing political concerns in Europe.

As of the current trading day, the EUR/USD is trading at 1.07401, opening at 1.07392, showing a slight change thus far. The market remains cautious ahead of key economic events and data releases. The pair’s movement is influenced by the ongoing political uncertainty in France, especially surrounding the legislative elections. UBS strategists note that while the risk of a significant drop in the euro exists, it is mitigated by the current political landscape where a ‘Frexit’ seems highly unlikely given the positions of key political figures.

Key Economic Data and News to Be Released Today

In Europe, political developments will continue to be a key driver for the euro. The yield gap between French and German government bonds, a measure of political risk, has slightly eased but remains elevated. This indicates ongoing concerns about potential fiscal instability within the Eurozone, which could influence investor sentiment and the euro’s performance.

Alsoa, traders should keep an eye on any statements or decisions from the Federal Reserve’s policy meeting. Market expectations are currently leaning towards a possible rate cut in the near term, with the CME FedWatch tool indicating a 67% chance of easing by September. Such a move would likely impact the EUR/USD pair by affecting the relative strength of the U.S. dollar.

EUR/USD Technical Analysis – 19/06/2024

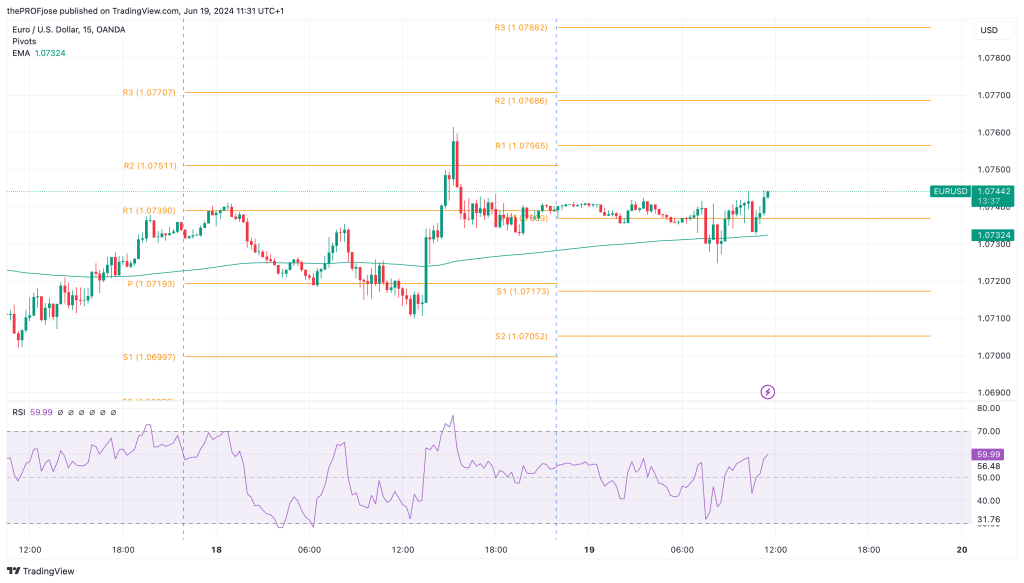

EUR/USD is bullish from a technical perspective. Earlier today, the pair dipped briefly to test the intraday 200 EMA, using it as a dynamic support level to further push price up.

Similarly, the RSI has crossed above the level 50, giving a further confirmation for the current bullish movement. We may witness a continous push all the way till the pair hits the overbought level before a significant pullback will be experienced.

EUR/USD Fibonacci Key Price Levels 19/06/2024

Short-term traders planning to invest in EUR/USD today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 1.07173 | 1.07565 |

| 1.07052 | 1.07686 |

| 1.06856 | 1.07882 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.