Who Participates in The Stock Market?

It is safe to say that the stock market attracts a wide variety of people and corporations from diverse backgrounds. How many people do you know that trade stocks? Do they all fit the same theme? I bet no! And that’s the beauty of it. You never know who you will come across next and their reasons behind getting into stocks. That’s why we love hearing the traders’ stories inside our Trading Room.

In general, the stock market is more than just traders and retail investors. There are stock brokers, stock exchanges, regulators, financial intermediaries, investment managers, and more. And everyone who transacts or is involved in the stock market is called a stock market participant.

In this lesson, we will take a closer look at four main stock market participants and how each participates in the stock market.

Who Are Investors?

Investors are individuals who own, buy and sell stocks in publicly listed companies and provide businesses with capital. Investors who own stocks are also called stockholders or shareholders.

Now, you may be thinking about whether there is a difference between being a trader and an investor. The answer is yes and no. Technically, in the stock world, you are an investor if you keep your shares for the long-term (for example, a period of over one year). On the other hand, you are a trader if you keep your shares for the short term only (for example, a period of 1 month).

There are also different types of investors – retail and institutional. Retail individual investors are regular people like you and me, whereas institutional investors are banks and big hedge fund companies and are typically part of the investment banking industry.

What Are Stock Exchanges?

Another market participant in the stock is a stock exchange. In simple terms, a stock exchange can be defined as a centralized location or a marketplace that brings buyers and sellers together and provides them with a platform to buy and sell securities. It ensures that securities transactions are done efficiently, fairly, and transparently.

It enforces rules and regulations that its publicly listed companies and trading participants must strictly abide by. Securities traded on a stock exchange include stock issued by listed companies via Initial Public Offering (IPO), unit trusts, derivatives, pooled investment products, and bonds.

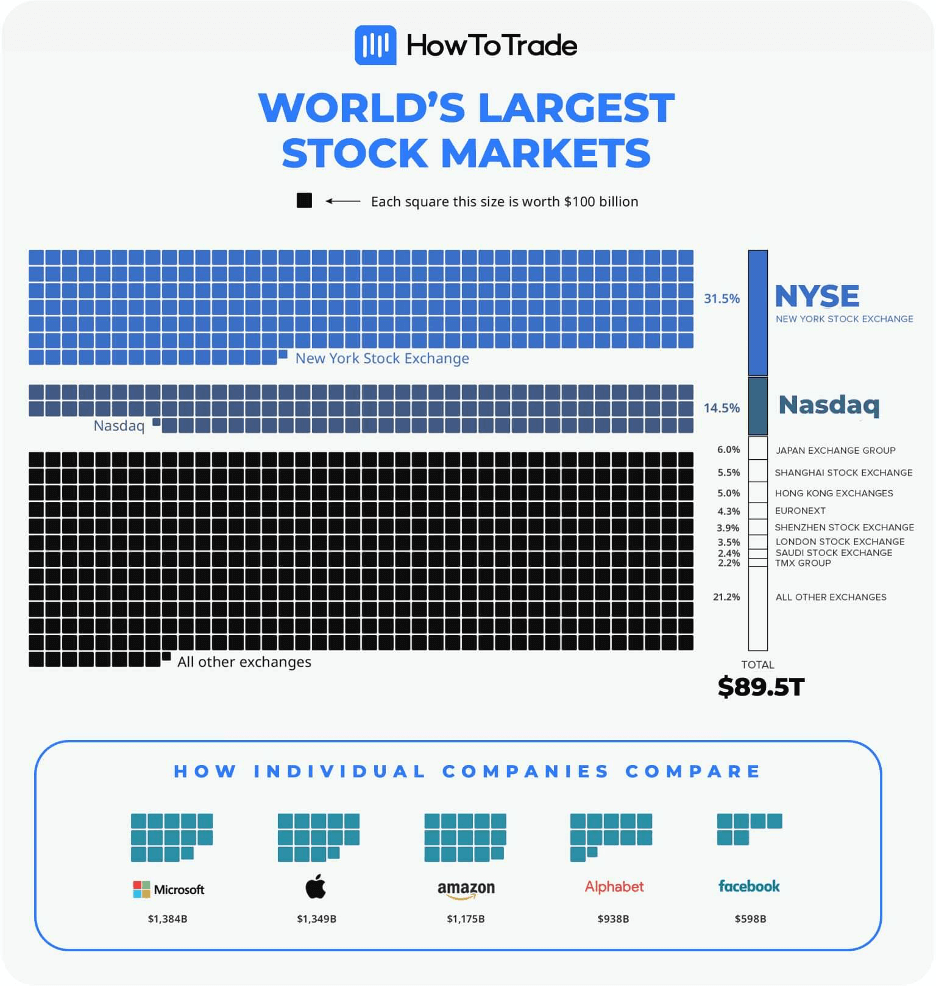

There are numerous stock exchanges located worldwide. Some of the largest exchanges are the New York Stock Exchange (NYSE), the NASDAQ, the Japan Exchange Group, the London Stock Exchange, the Hong Kong Exchange, Euronext, the Shanghai Stock Exchange, the Bombay Stock Exchange, and many more.

Now, we know it may be difficult to picture what it looks like in real life, so here’s how ten major stock exchanges worldwide compare. By the way, each square is worth $100 billion.

What Are Stock Brokers?

Stock brokers or share brokers are probably one of the most important financial intermediaries as they act as the middlemen or agents between sellers and buyers in the stock market.

As self-regulatory organizations, they buy and sell stocks and other securities for retail and institutional clients through a stock exchange or over the counter in return for a fee or commission. They are the only ones who are entitled to provide access to the stock market. Without them, buying and selling such securities as shares, mutual funds, corporate bonds, and options is impossible.

Stockbrokers are usually associated with a brokerage firm or broker-dealer and operate under the guidelines and rules of regulators. There are different types of brokers – full-service, discount, and direct access.

The main difference is in how the commissions are structured and the services each type of stockbroker is authorized to provide its clients. But more on that later. For now, all you need to know is that stock brokers are your gateway to stock exchanges and that they are a significant part of the stock market.

Who Are Regulators?

Your protection is a priority, especially when it comes to stocks, the primary market, and the secondary market. There are several organizations, globally and domestically, whose main job is to protect investors from fraud and other illegal activities and ensure efficient markets and a free market economy.

You may have heard of a few of them. The Securities and Exchange Commission (SEC), the National Securities Exchange (NSE), the Securities and Exchange Board of India (SEBI), the National Securities Depository Limited, or the Financial Industry Regulatory Authority (FINRA)? Do any of them ring a bell? All of these regulators oversee the stock exchanges worldwide and every company connected with the selling of securities.

These regulators ensure that stock exchanges conduct their business fairly, that participants do not get involved in fraudulent activities, and that small retail investors’ interests are protected. On top of that, these organizations have a robust anti-fraud branch that ensures that the corporations comply with strict security rules. They also must audit the processes of transfer agents, which are third-party entities responsible for managing changes in ownership of companies’ securities.

Now, there are more participants in stock markets than these four, including insurance companies, investment banks, hedge funds, credit rating agencies, central banks (especially the Federal Reserve Bank), and governments. Still, to keep things simple and clear, we won’t go into more detail about the remaining ones.

To help you visualize how the stock market works and who are the primary securities market participants in the capital market, we will leave you with this graphic.

The Bottom Line

The bottom line is that you, as an individual trader, must know who are the main market participants in the stock market and financial markets. It is crucial for you to know who has more power and how large institutions, broker-dealers, regulators, and stock exchanges can affect stock prices. For example, if you use a level 2 order book in your trading account, you might see market makers, large banks and hedge funds, and even governments trying to get orders to buy or sell an asset.

In other cases, you might have to be alert to any announcement from the regulator, the stock exchange, or your brokerage firm. Ultimately, it can help you to better understand the stock market, and avoid trading mistakes.

In the next lesson, we’ll explore the stock trading hours of each stock exchange and area worldwide. See you in the next lesson.