How Does Silver Affect the Forex Market?

As we discussed in a previous lesson, the USD is negatively correlated with the price of gold. So, what about silver? You guessed it: the USD is negatively correlated with silver as well.

Of course, the relationship is a bit more nuanced between the USD and silver bullion than with gold. The production and exportation of physical silver are much different than gold’s. However, it can still have a palpable impact on the foreign currency markets.

Read on to learn more about how silver price and other precious metal markets, can impact forex valuations.

Precious Metals and the USD

What do crude oil, corn, copper, platinum, and other precious metals have in common? They’re all commodities. And, as commodities, they negatively correlate with the US dollar (USD). Why? The reason is simple: most of the world’s commodities are quoted in USD.

Therefore, commodity prices tend to fall when the USD rises against other major currencies. Given this dynamic, the silver and gold prices per troy ounce are poised to retrace.

It works the other way too! During the periods of USD downtrend, commodity prices tend to make huge gains. So, as the USD becomes devalued, silver prices are likely to rise. Although this isn’t always the case, it isn’t a bad way to represent silver prices in relation to the USD.

But we always tell you to think positively! So, for the sake of this lesson, we will take our own advice and explore the POSITIVE correlations of silver to paper currency pairs.

To kick things off, let’s look closer at silver’s correlations with AUD/USD.

The Correlation of Silver prices and AUD/USD

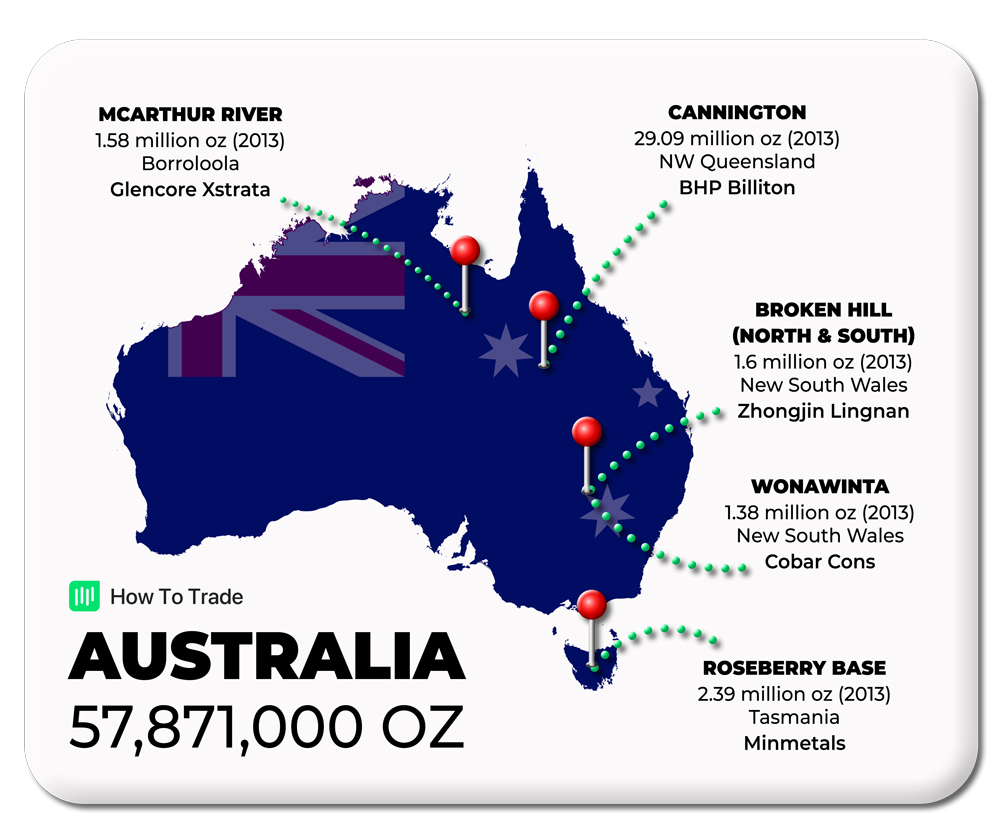

Before we dig deeper into silver and Australia’s entanglements, it is essential to note that Australia is not only a top-three gold producer worldwide but also a MASSIVE producer of physical silver!

That’s a lot of silver. You can only imagine the impact of such an amount on Australia’s overall economy. To say the least, the global silver investment in AUS is nothing to sneeze at!

Before we go further, you’ll remember that the forex code for the gold market was XAU; for silver, it’s XAG. Accordingly, the key forex pair that addresses the global silver market is the XAG/USD.

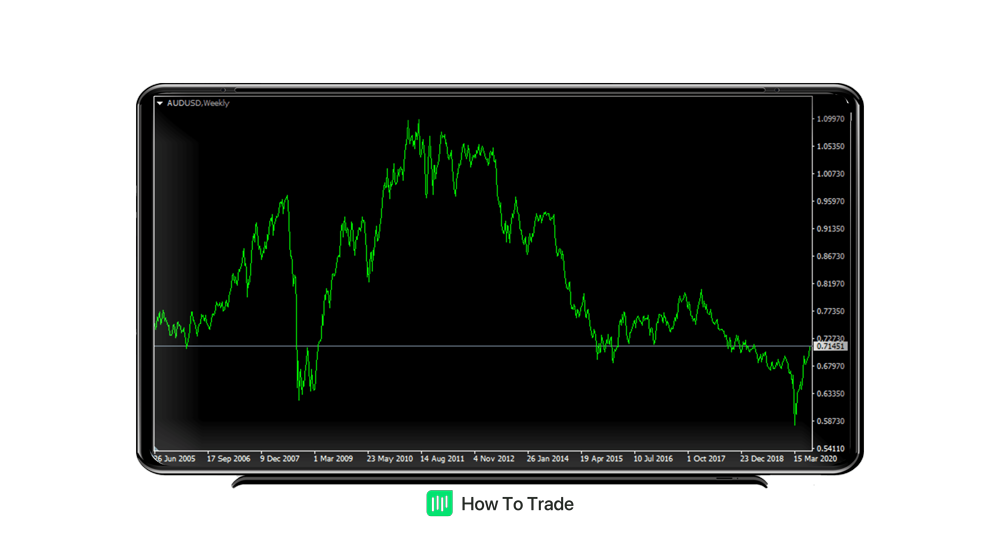

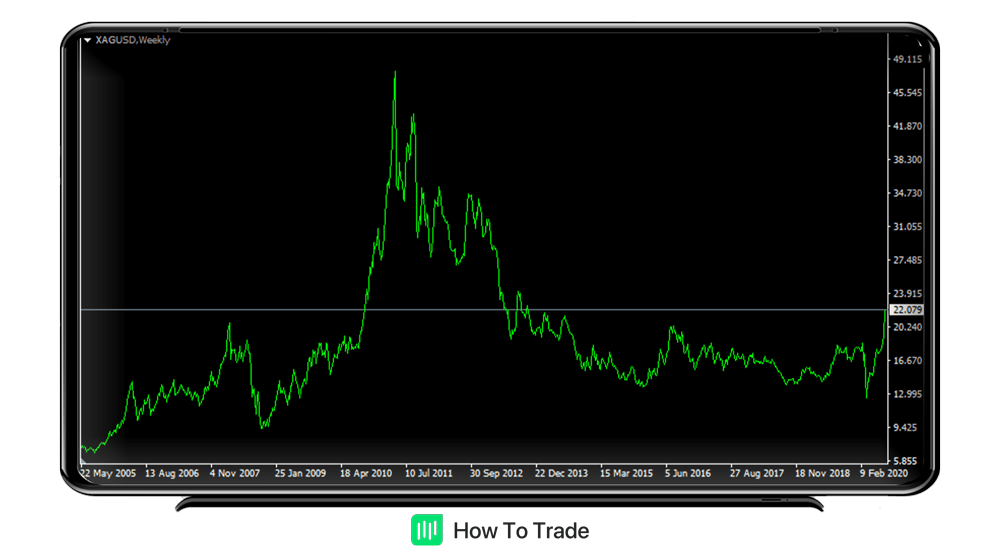

Now, let’s compare the movements of the Aussie (AUD/USD) and XAG/USD over the past 15 years. Do you see any of the standard USD/precious metal correlations?

Their movements have been pretty similar over the past couple of years, wouldn’t you say? Can you spot the positive correlation between AUD and XAG prices?

As silver prices move up and down, so does the AUD. In fact, the correlation is very similar to that of the AUD and gold price. That’s why many view the AUD to be a viable safe haven investment alternative. Because the Aussie positively correlates to gold and silver prices, it can be viewed as a proxy for these two precious metals.

Key Takeaways

- There is a positive correlation between AUD and XAG prices, meaning that they tend to move in the same direction.

- This correlation is due to the fact that both AUD and XAG are seen as safe haven assets.

- Investors often buy silver and AUD when they are worried about the economy.

- The correlation between AUD and XAG prices is not perfect, but it is still very strong.

- Traders who are bullish on silver may also want to consider buying AUD. Conversely, traders who are bearish on silver may also want to consider selling AUD.

Want to learn more about how Silver affects currencies?

As in all things forex, experience is the best teacher. To learn more about how the silver market affects currencies, screen time is your number one asset. Watching the ebbs and flows of silver prices is a great way to learn how precious metals can impact currencies.

So, the next time you trade, don’t forget about the silver markets! Pull up the XAG/USD chart and get to it!