Key Points

- Volatile day ahead for GBPUSD.

- The data from the UK has been positive.

- The dollar continues to grind higher.

- GBPUSD turning bearish?

Key Events Today

The main talking points over the last few days have come from the election debates and speeches from the UK and the US. Last night, Labour’s Keir Starmer and Conservative’s Rishi Sunak had their final debate live in front of the nation ahead of the 4th July election, with Labour expected to win a majority.

Today, during the US session, attention will turn to important economic data. The Final GDP q/q figure is set to be released later this afternoon and is expected to show an uptick of 0.1% to 1.4% growth. This is still considerably weaker than the previous quarters. However, a combination of stronger GDP and lower unemployment claims today could be a recipe for more dollar strength, sending GBPUSD lower. On top of this, Pending Home Sales m/m and Durable Goods Orders m/m data are due out, promising an exciting trading day ahead.

Inflation Data Looms

Tomorrow, traders will eagerly anticipate the Core PCE Price Index, the Federal Reserve’s primary inflation gauge. Much has been said about the recent pushback on rate cuts in the latest meeting, and Friday’s data will help determine whether this is the correct approach. The forecast is for a fall in the month-on-month figure to 0.1% from 0.2%, which may weaken the dollar, resulting in a boosted GBPUSD. However, inflation in the US is still too high for the Federal Reserve’s liking, and a figure higher than forecasted will likely continue the dollar rally.

Dollar Grinding Higher

Despite the seemingly weaker US data, the DXY has been grinding higher. This is evident from the series of higher highs and lower lows the market has been making on the H4 chart.

Yesterday, the price broke the recent market structure high at 105.920 and has since breached 106.000 in a show of strength. Traders may want to utilise one of the Fair Value Gaps in green to continue this bullish trend.

Should the price reach 106.400, a key order block could prove to be resistance. This will be a critical test for the US dollar, determining the medium-term direction of the DXY.

GBP/USD Turning Bearish?

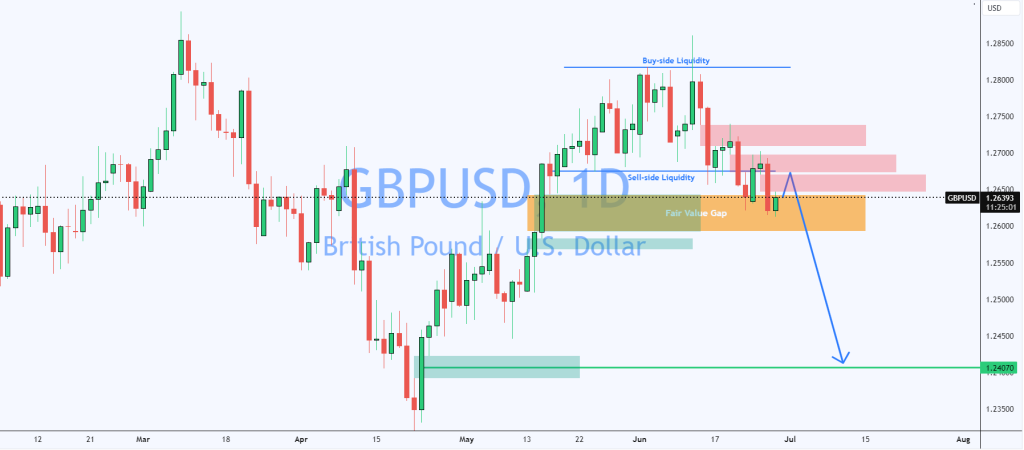

GBPUSD’s price has finally broken out of the daily range mentioned in my previous cable article. Therefore, you could argue that GBPUSD has shown its hand and looks like it will turn bearish.

The price currently trades inside a daily Fair Value Gap and is proving to be supportive, for now. However, with the market breaking below the previous sell-side liquidity, there are signs that GBPUSD is about to collapse. Should the price break below this FVG, we could be on for a broader move lower to 1.24000.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.