Key Points

- June has been a negative month for the DOW 30. Prices are off by more than 0.5%, with most of these losses coming this week.

- Fed monetary policy uncertainty is the reason for the non-committal market conditions.

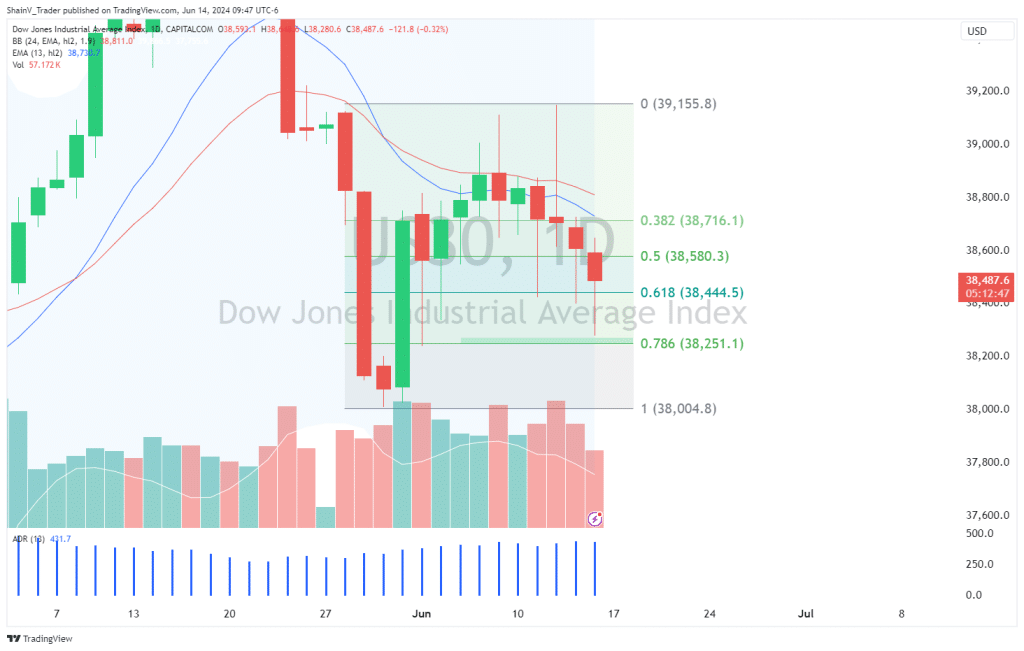

- Key daily support is present at 38,250 – 38,275.

Market Overview

The Dow Jones 30, also known as the DOW, DJIA, or US30, is the premier stock index in the world. It represents the 30 largest companies in the United States. Accordingly, it is a primary barometer for equities valuations and a staple in countless portfolios.

Since Wednesday’s Fed Announcements, the DOW is off by more than 0.5%. With the weekend break rapidly approaching, it appears traders are taking a risk-off stance toward US large caps.

A Flat June For The DOW

June has been a flat month for the DOW. Prices are off a modest -0.60%, with most of the losses posted this week. Why? Three words: interest rate uncertainty.

As a general rule, higher interest rates mean bearish stocks. Conversely, lower interest rates equate to bullish stocks. The markets are looking to late-year interest rate cuts to boost equities. In fact, this week’s dovish CPI and PPI reports have many believing a September rate cut to be a foregone conclusion. The CME FedWatch Index is currently pricing a 70% chance of at least a ¼ point rate cut to be instituted in September; the odds stood at 50/50 one week ago.

The uptick in the CME FedWatch suggests the markets anticipate easing monetary policy sooner rather than later. But will the Fed cut rates? Not necessarily. At Wednesday’s presser, J. Powell stated that inflation was still “too high” and that pricing stability had not yet been achieved. The Fed’s Dot Plot showed that there is only one ¼ point rate cut in the cards for 2024; this was a major revelation as many analysts predicted at least two cuts by New Year’s Eve.

The bottom line? Monetary policy uncertainty persists. Subsequently, US large caps and the US30 are now working through a short-term consolidation phase.

US30 Technical Outlook

The US30 is on a three-day losing streak. Will Friday be number four? Possibly. At press time, the DJIA is down more than 100 points but well off intraday lows.

As you can see, the US30 tested a key daily support zone earlier in the session. Bidders defended the Daily 78% Fibonacci retracement (38,251) with vigor. If retested, this area will likely act again as significant downside support. Buys from 38,275 to 38,250 aren’t a bad way to buy the June dip.

The past five days have been jam-packed with market-moving events. US CPI, PPI, and the Fed Announcements have paced the action. Next week features a much lighter economic calendar. Given the forthcoming vacant news cycle, it’s wise to respect the long-term bullish trend in the US30.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.