Key Points

- Next week, the key events for silver (XAG/USD) are the US Fed Announcements (Wednesday) and US Non-Farm Payrolls (Friday).

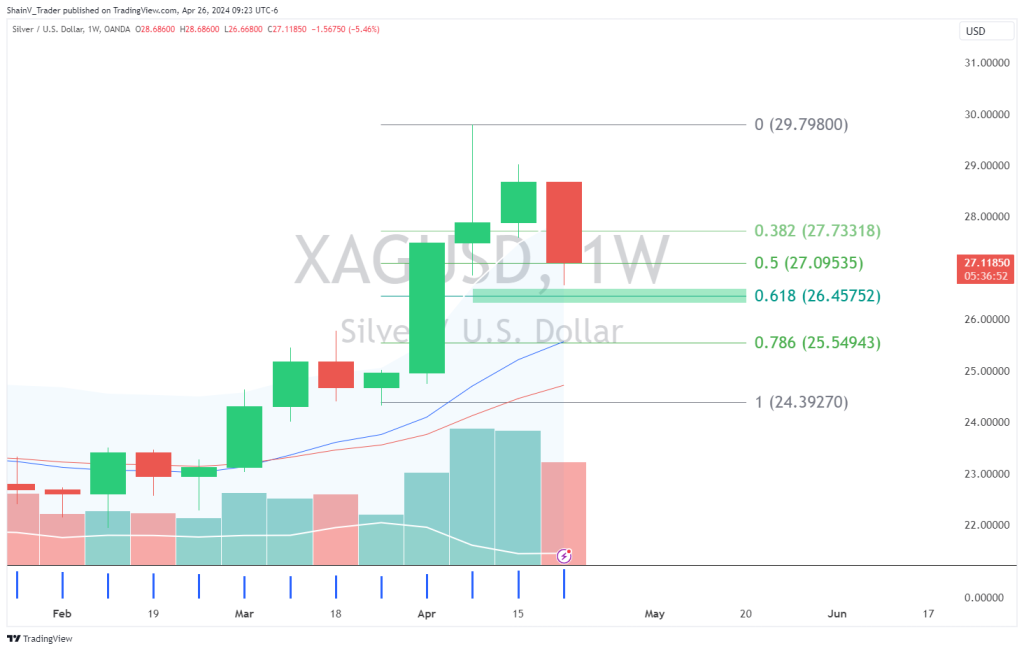

- Silver has posted its first negative week in five, losing more than 4%.

- The weekly pullback has brought a key Fibonacci support level (26.457) into view.

The coming week will be big for silver (XAG/USD). Two key events headline the action: the FOMC Announcements (Wednesday) and US Non-Farm Payrolls (Friday).

At press time, silver is positioned to post its first losing week in the past five. Prices are off more than 4% as profit-taking and interest rate concerns have dominated sentiment. Can silver bounce back in the short term? Perhaps. One thing is for certain — next week’s economic calendar will drive heavy participation to the XAG/USD.

Flat Pricing Ahead Of The Fed

Next Wednesday marks the third meeting of the FOMC in 2024. The impact is being felt across the markets, specifically in metals. Since 1 January, geopolitical tensions and the promise of Fed rate cuts have boosted metals prices. Now, that appears to be changing.

The phrase “higher for longer” has gained traction on Wall Street, much to the dismay of gold and silver bugs. “Higher for longer” means that the Fed aims to hold interest rates at or near current levels for an extended period to reduce inflation. If true, then bearish pressure is highly likely to hit the metals markets.

Fed Expectations, NFP To Drive Silver

Silver’s pricing will hinge on what the Fed does Wednesday. As of this writing, the CME FedWatch Index is assigning a 97% chance that the Fed holds rates static at 5.25-5.5%. In fact, the FedWatch isn’t expecting a rate cut until September at the earliest. This is a dramatic shift in expectations over the past few months. It’s also a big reason why significant selling is hitting silver.

Aside from the Fed, US Non-Farm Payrolls (NFP) will drive late-week action. Analysts estimate that NFP is to come in at 210,000 for April, down from 303,000 in March. Are these numbers accurate? At this point, any NFP figures are highly suspect. Throughout 2024, revisions have been the rule; Friday’s report is likely to bring more. Either way, silver will be active in the hours surrounding the NFP release.

Weekly 62% Retracement In Play For Silver

With such five active sessions coming up, it always helps to identify key levels well in advance. This is a weekly chart for the XAG/USD. As you can see, the market has put in a proximity test of the Weekly 62% Fibonacci Retracement (26.457).

A retest of this area may produce another opportunity to buy. The FOMC Announcements and NFP are more than capable of sending the XAG/USD back to this key level. If this scenario develops, then longs from the 26.500 are solid entries to the bull. After all, the long-term uptrend for silver remains valid going into May’s trade.

Next week’s economic calendar is extremely active. If you’re in the market, be sure to stay vigilant. The key events mentioned here, and others, have the potential to create sudden volatility. Preparedness and prudent risk management are your keys to succeeding in this hyper-active news cycle.

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.