Key Points

- The fundamental outlook for gold remains bullish.

- New Home Sales fell 11% month-over-month to the lowest rate in six months.

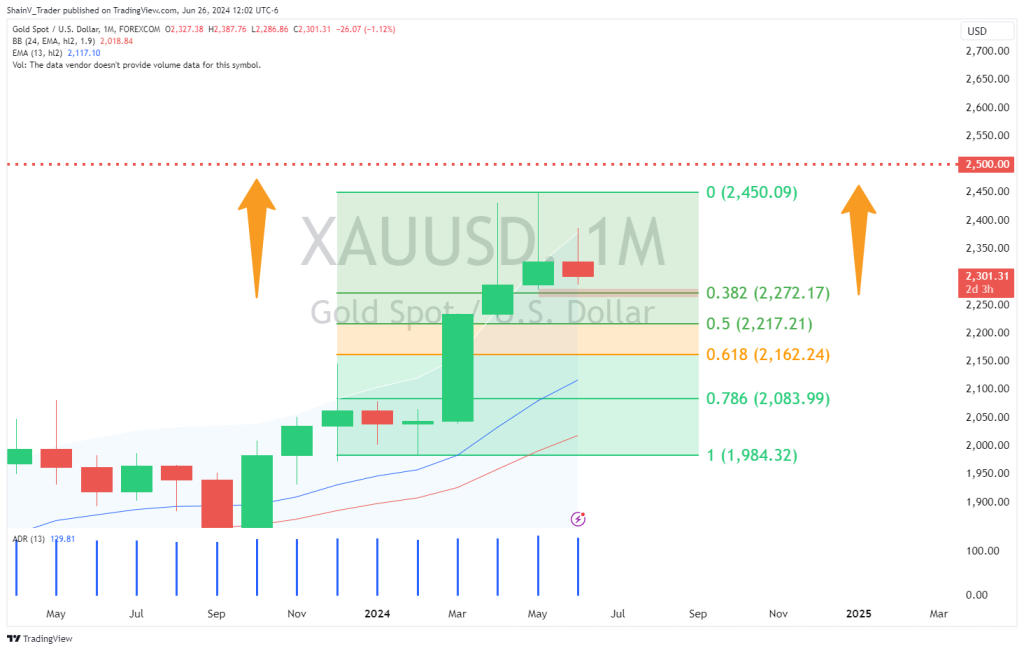

- Macro support for XAUUSD is located at 2272.17, the Monthly 38% Retracement level.

Market Overview

Mid-week trade has been a rollercoaster for precious metals, headlined by a near 1% plunge in gold (XAU/USD). The reason for the chaotic action is unclear, but may be attributed to the rally in the USD. At press time, the USD Index (DXY) is trading in the vicinity of 106.000, up more than 0.35% on the session.

New Home Sales Disappoint

During the US pre-market hours, US New Home Sales hit the newswires. The number came in dreadfully low for May, off 11% month-over-month. This marked the lowest reading in six months and the worst of 2024.

Historically, the US real estate market has been viewed as a leading indicator of broader economic growth. Thus, robust home sales suggest economic expansion, while sluggish home sales indicate possible contraction. Today’s New Home Sales report falls into the latter category, illustrating a possible slowdown in economic growth.

When a leading indicator misses its mark to the downside, the USD struggles to hold market share. That hasn’t been the case today, as the DXY has held firm and gold hasn’t.

A Bullish Bias For Gold?

From a fundamental perspective, building a bullish case for gold isn’t hard. Geopolitics and monetary policy remain bullion’s greatest market drivers — both point to the upside.

Recent escalations in the Russia/Ukraine war and new developments on the Israel/Hamas front have many investors actively managing risk. Also, US political uncertainty regarding November’s election persists. Uncertainty typically draws bids to safe-haven assets; the 2024 gold market is certainly an example of this phenomenon.

On the monetary policy front, the market’s interest rate expectations are softening. For the second straight week, MBA 30-year Mortgage Rates fell and held firm below 7%. This indicates that many long-term lenders are anticipating Fed policy to loosen sooner rather than later. Ultimately, this is a dovish sign for the USD and a bullish one for gold.

Technical Outlook

Given the market drivers facing bullion, looking for a solid entry point isn’t a bad strategy. Long-term support is present at the Monthy 38% Retracement (2272) area. Should a test of this zone come to pass, bids from the 2272-75 area are premium entries to the bull.

If you’re trading gold this week, it’ll pay to stay aware of the current news cycle. Thursday brings the first US Presidential Debate of 2024, and Friday features the PCE Price Index. Be sure to manage risk aggressively during the Thursday and Friday sessions.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.