Key economic data to be released today include the NY Empire State Manufacturing Index, which could influence expectations for a Fed rate cut.

Key Points

- Michigan Consumer Sentiment Index fell, impacting US markets.

- The DAX 40 opened at 17,999.55 and is trading at 18,027.99, up 0.07%.

- NY Empire State Manufacturing Index release today could affect Fed rate cut expectations.

DAX 40 Daily Price Analysis – 17/06/2024

On Friday, June 14, the DAX 40 declined by 1.56%, closing at 17,999.55 after opening at 18,284.80. This marked a continuation of the downward trend from Thursday, when the index slid by 1.96%, ending the session at 18,002. Key economic data released on Friday included the narrowing of the Eurozone trade surplus from €23.7 billion to €15.0 billion in April. Despite this, the trade data had a limited impact on the DAX, with market sentiment being heavily influenced by political uncertainties, particularly around the snap French election. The election saw the RN leading with 29.5% of the vote, creating jitters in the European equity markets.

Later in the session, the Michigan Consumer Sentiment Index fell from 69.1 to 65.6, raising concerns about the US economic outlook. This mixed session for the US equity markets saw the Nasdaq Composite Index gain 0.12%, while the Dow and S&P 500 declined by 0.15% and 0.04%, respectively. In Europe, bank stocks suffered due to EU-related fears, with Commerzbank and Deutsche Bank falling significantly. Additionally, concerns over potential Chinese retaliation to EU tariffs on EV imports impacted auto stocks, with major players like Daimler Truck Holding, BMW, Porsche, and Volkswagen all experiencing losses.

As of the current trading day, June 17, the DAX 40 opened at 17,999.55 and is trading at 18,027.99, marking a modest gain of 0.07%. This slight uptick follows a tumultuous end to last week and suggests a cautious recovery. Early trading reflects some stability, but market participants remain wary of ongoing economic and political developments.

Key Economic Data and News to Be Released Today

Later today, the NY Empire State Manufacturing Index numbers will be released. These figures will be crucial for gauging the health of the US manufacturing sector and could influence

expectations for a Fed rate cut in September. Any unexpected downturn in these numbers could heighten fears of a hard landing for the US economy.

DAX 40 Technical Analysis – 28/05/2024

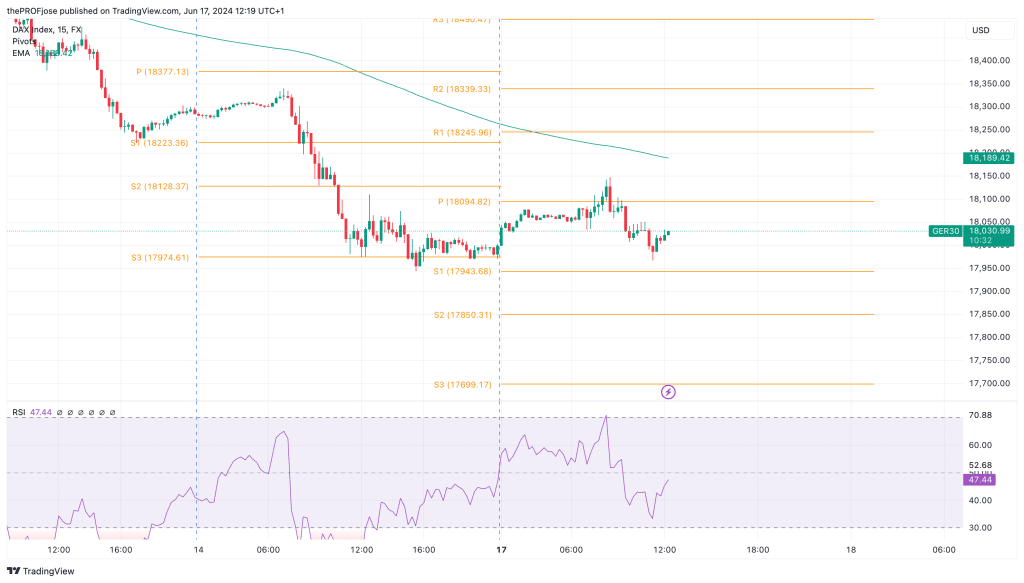

Dax today seems to want to continue friday’s bearish tone. Looking at the price action, the index is trading steadily below the 200 EMA, showing a strong movement to the downside.

Additionally, the RSI also has retreated a little but it is still trading below the level 50 line. This suggests that the market momentum is equally bearish, as well. Traders looking to go short on the dax should ensure they stick to their plans.

Dax 40 Fibonacci Key Price Levels 28/05/2024

Short-term traders planning to trade the Dax index today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 17943.68 | 18245.96 |

| 17850.31 | 18339.33 |

| 17699.17 | 18490.47 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.