Today, Silver has declined by -0.55%, with ongoing USD strength and a positive risk tone limiting gains.

Key Points

- Silver declined by -0.27% last trading day due to the Fed’s hawkish stance and a strong USD.

- Today, Silver is down by -0.55%, with USD strength and positive market risk tone limiting gains.

- Key US economic data releases today include expected modest growth in Core Retail Sales and Retail Sales.

Silver Daily Price Analysis – 18/06/2024

On monday, Silver opened at $29.645 and closed at $29.390, marking a -0.27% decline. This decrease was largely influenced by the Federal Reserve’s hawkish stance, which suggested only one interest rate cut for the year. This outlook boosted US Treasury bond yields, thereby strengthening the USD and exerting downward pressure on Silver prices. The dip-buying of the USD added further headwinds for Silver, as investors reacted to positive macroeconomic data indicating easing inflationary pressures. Despite these challenges, the market’s anticipation of future rate cuts by the Fed provided some support for Silver.

As of the current trading day, Silver opened at $29.545 and has declined to $29.230, a -0.55% change so far. The ongoing strength of the USD, bolstered by expectations of robust US economic performance and relatively high Treasury yields, continues to limit Silver’s gains. The general positive risk tone in the markets also caps the safe-haven demand for Silver, making it difficult for prices to rally without substantial buying momentum.

Key Economic Data and News to Be Released Today

Today, investors are keenly awaiting key US economic data releases. Core Retail Sales and Retail Sales figures, expected to show growth of 0.2% and 0.3% respectively, will provide critical insights into consumer spending and economic health. Industrial Production data, forecasted to increase by 0.3%, will also be closely watched. These indicators are likely to create short-term trading opportunities for Silver.

Additionally, speeches from several influential FOMC members will likely impact market sentiment and USD demand. Comments from Philadelphia Fed President Patrick Harker, emphasizing the need to maintain current rates to control inflation, have already added pressure on Silver prices. The market will be looking for any hints about the Fed’s future policy moves, which could significantly influence Silver’s price trajectory.

Silver Technical Analysis – 18/06/2024

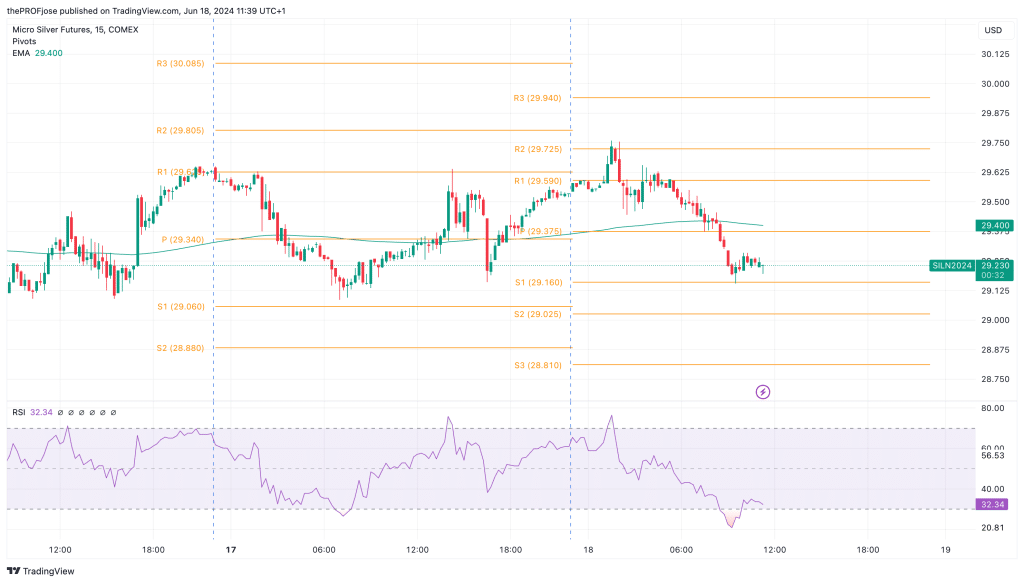

Silver price action seems to be consolidating this session. Although the trend seems to be bearish, trending below the 200 EMA, the RSI trading below the level 30 suggest that a reversal is imminent.

The direction of the metal is not yet clear to take a definitive action at the moment. It is advisable to wait for the high impact data release today to give direction to the market before jumping on any trade idea.

Silver Fibonacci Key Price Levels 28/05/2024

Short-term traders planning to trade XAG/USD today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 29.160 | 29.590 |

| 29.025 | 29.725 |

| 28.810 | 29.940 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.